.jpg) Following the surprise announcement that Mark Carney will be departing to helm the Bank of England, it was back to business as usual at the Bank of Canada as interest rates were once again held constant at 1 per cent. The statement released this morning in support of the interest rate decision noted that while the global economy appears to have stabilized, it still remains vulnerable to major shocks from the US or Europe. The Canadian economy is growing at a slightly softer pace than...

Following the surprise announcement that Mark Carney will be departing to helm the Bank of England, it was back to business as usual at the Bank of Canada as interest rates were once again held constant at 1 per cent. The statement released this morning in support of the interest rate decision noted that while the global economy appears to have stabilized, it still remains vulnerable to major shocks from the US or Europe. The Canadian economy is growing at a slightly softer pace than...

News: Vancouver Real Estate MarketBill C-38 - What does it mean for property owners along pipelines?

These changes affect the operation of the National Energy Board (NEB), which has potentially serious implications for property owners along pipelines.

This includes the 2,200 property owners along the Trans Mountain Pipeline, owned by Kinder Morgan, which runs from the Alberta tar sands and... Housing market sees slight changes in October - REBGV The Real Estate Board of Greater Vancouver (REBGV) reported 1,931 residential property sales of detached, attached and apartment properties on the region’s... BC Home Sales Forecast to Grow in 2013 - BCREA

Vancouver, BC – October 26, 2012. The British Columbia Real Estate Association (BCREA) released its 2012 Fourth Quarter Housing Forecast today.

BC Multiple Listing Service® (MLS®) residential sales are forecast to decline 9.8 per cent to 69,200 units this year, before increasing 8.3 per cent to 74,920 units in 2013. The fifteen-year average is 79,000 unit sales, while a record 106,300 MLS® residential sales were... Vancouver Laneway Homes, Coach Homes & Carriage Homes

Laneway houses present an excellent opportunity for homeowners to increase the value of their existing homes by adding... What A Strata Corporation Needs to Know About Depreciation ReportsWhat is a depreciation report? A depreciation report is a legislated planning requirement for strata corporations in British Columbia. Depreciation reports are used to establish long term planning for common property and common assets to determine:

1) What assets you own ( an inventory )

Tighter Regulation Trims Home Sales - BCREA Royal LePage House Price Survey (Q3)Canadian House Prices Edge Up in Third Quarter While the Number of Home Sales Fall First-time buyer activity drops as market adjusts to new mortgage regulations TORONTO, October 3, 2012 – The Royal LePage House Price Survey released today showed the average price of a home in Canada increased year-over-year between 1.8 and 4.8 per cent in the third quarter of 2012.

Survey findings indicated that the average standard two-storey home in Canada increased 4 per cent year-over-year rising... Conditions continue to favour buyers in the Greater Vancouver housing market - REBGVThe summer of 2012 drew to a close in September with home sale activity well below historical averages in the Greater Vancouver housing market. Canadian and US Employment - BCREA Canadian job growth bounced back in August as employment expanded by 34,300. Just as last month's over 30,000 job losses were entirely due to part-time employment, this month's gains were the result of those jobs being added back. Part-time employment grew by 46,700 while, full-time employment fell 12,500. The Canadian unemployment rate held steady at 7.3 per cent Home sellers continue to outnumber buyers in Greater Vancouver's summer housing market - REBGV

BC Commercial Leading Indicator Points to Strong Growth Ahead - BCREAFor the complete news release, including detailed statistics, click: here.

Vancouver, BC – August 28, 2012. The BCREA Commercial Leading Indicator (CLI) continued to trend higher in the second quarter of 2012, rising 0.8 points to 112.6 from a revised level of 111.8 in the first quarter. On a year-over-year basis, the CLI is now 3.7 per cent above its level in the second quarter of 2011.

" Greater Vancouver housing market hits summer lull - REBGVResidential property sales in Greater Vancouver remained at a 10-year low in July, while the number of properties being listed for sale continued to edge down and prices remained relatively stable.

The Real Estate Board of Greater Vancouver (REBGV) reports that there were 2,098 residential property sales of detached, attached and apartment properties in July. That’s an 18.4 per cent decline compared to the 2,571 sales in July 2011 and an 11.2 per cent decline compared to... What Non-Residents Need to Know About TaxesProperty in the Lower Mainland continues to attract investors world-wide. It is therefore important for you (the non-resident) to understand Canada’s tax laws to help avoid mistakes and pitfalls. Here is a brief summary of information, relevant to you the foreign investor:

Resident or non-resident? Under Canada’s income tax system, whether an individual is a resident or a non-resident can play a role in how much tax you will pay.

Greater Vancouver housing market favoured buyers in June - REBGVThe number of residential property sales hit a 10-year low in Greater Vancouver for June, while prices remained relatively stable.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales of detached, attached and apartment properties reached 2,362 in June, a 27.6 per cent decline compared to the 3,262 sales in June 2011 and a 17.2 per cent decline compared to the 2,853 sales in May 2012.

June sales were the lowest total for the month in... Federal Government Changes to Mortgage Lending - BCREAFor the fourth time in the past four years, the Federal Government has announced further action to restrict mortgage credit. The new measures include:

Housing Markets to Shine in 2012: BCREA 2012 Second Quarter Housing ForecastVancouver, BC – June 6, 2012. The British Columbia Real Estate Association (BCREA) released its 2012 Second Quarter Housing Forecast today.

... Spring activity remains balanced in the Greater Vancouver housing market - REBGVThe number of properties listed for sale continued to increase in the Greater Vancouver housing market in May. The number of sales decreased year over year, but remained relatively constant compared to recent months.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales in Greater Vancouver reached 2,853 on the Multiple Listing Service® (MLS®) in May 2012. This represents a 15.5 per cent decline compared to the 3,377 sales recorded in... Canadian Consumer Price Inflation - BCREACanadian CPI inflation registered 2.0 per cent (year-over-year) in April, a 0.1 point increase from March inflation of 1.9 per cent. The rise in consumer prices was led by transportation costs, including a 3.3 per cent rise in gasoline prices. In fact, Statistics Canada's gasoline Index reached a 4 year high in April. The Bank of Canada's core inflation measure, which excludes food and energy prices, rose 2.1 per cent in April, up from 1.9 per cent in March. Consumer prices in BC were 1.6 per cent... Canadian Manufacturing Shipments | US Housing Starts - BCREACanadian manufacturing sales increased 1.9 per cent in March, the largest advanced since September 2011. The gain was largely driven by higher sales of petroleum and coal products, though higher sales were reported in 13 of the 21 manufacturing sectors surveyed.

BC manufacturing sales rose 0.4 per cent on a month-over-month basis in March but were 0.4 per cent lower than in March 2011. BC manufacturing sales were lead higher by a rebound in BC’s non-durables goods sector... Labour Force Survey - BCREACanadian employment rose by 58,000 jobs in April following a blockbuster March in which employment increased by 82,000. Despite large job gains in the past two months, the national unemployment rate edged up 0.1 points to 7.3 per cent as more Canadian were looking for work.

Employment in British Columbia expanded by 19,700 in April, including 16,700 full-time positions. The BC unemployment rate fell by a surprising 0.8 points to 6.2 per cent. BC employment growth is up 2.1 per... Canadian Building Permits - BCREACanadian building permits continue to show strength, rising 4.7 per cent month-over-month in March. The gain at the National level was mostly the result of higher institutional and commercial activity in Ontario, which were up 65 per cent and 15 per cent higher respectively.

Construction intentions in BC tumbled 29 per cent in March, though from a very active February that saw over $1 billion in permits. On a year-over-year basis, total building permits were down 13 per cent from... Greater Vancouver housing market maintains a steady spring paceHome sale and listing activity has maintained a consistent pace on the Multiple Listing Service® (MLS®) in Greater Vancouver in recent months, which has helped create balanced conditions for the region’s housing market.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales in Greater Vancouver reached 2,799 on the Multiple Listing Service® (MLS®) in April 2012. This represents a 13.2 per cent decline compared to the 3,225... How To Choose a Real Estate Agent

Buying your first home is a very exciting yet stressful time. It's one of the most important decisions you'll ever make and one of the main reasons to seek professional advice. The right advisor will help guide you through the buying process and help you lay the foundation for an enjoyable home ownership experience. The sooner you start working with an agent the better. As a buyer there are typically no costs to hire a REALTOR®. Most agents offer a complimentary new home buyer orientation which... Bank of Canada Interest Rate Decision - BCREAThe Bank of Canada left its overnight rate unchanged at 1 per cent for the 13th consecutive meeting. In the statement accompanying the decision the Bank noted that economic momentum in Canada is slightly firmer than the Bank had forecast in January and that economic headwinds from the US and Europe have abated somewhat. However, the Bank still judges the continued accumulation of debt by Canadian households to be the biggest domestic risk facing the economy. The Bank further noted that... No March Madness Repeat in 2012 - BCREAFor the complete news release, including detailed statistics, click here.

Vancouver, BC – April 13, 2012. The British Columbia Real Estate Association (BCREA) reports that the dollar volume of homes sold through Multiple Listing Service® (MLS®) in BC declined 26.5 per cent to $3.8 billion in March compared to the same month last year. A total of 6,882 MLS® residential unit sales were recorded over the same period, a decline of 20 per cent. The average MLS®... Increased selection helps maintain balance in Greater Vancouver housing marketHome sales in March trended below the 10-year average in Greater Vancouver while home listing activity outpaced what’s typical for the month.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales in Greater Vancouver reached 2,874 on the Multiple Listing Service® (MLS®) in March 2012. This represents a 12.9 per cent increase compared to the 2,545 sales recorded in February 2012, a decline of 29.6 per cent compared to the 4,080... Canadian Monthly GDP - BCREAThe Canadian economy got off to a slow start to begin 2012, failing to build on momentum from December. January Gross Domestic Product grew just 0.1 per cent, after posting robust 0.5 per cent growth in the final month 2011. Economic growth in January was given a boost by manufacturing output which rose for the fifth consecutive month, but was dragged lower by declining oil and gas extraction. On a year-over-year basis, real GDP growth was 1.7 per cent in January.

The Canadian... US Housing Starts - BCREAUS housing starts declined slightly in February, though January new construction was revised higher. Total housing starts were at a seasonally adjusted annual rate(SAAR) of 698,000 last month, down 1 per cent from 706,000 (SAAR) in January. Building permits, an indicator of future home construction, were 717,000 (SAAR) in February, a 5 per cent increase from January and 3 per cent higher than February 2011.

While this morning's report is not overly positive, it does reinforce that the housing... Home Sales in Interior and North Outpace Province - BCREA

... Bank of Canada Interest Rate Decision - BCREAThe Bank of Canada left its overnight rate unchanged at 1 per cent for the twelfth consecutive meeting. In the statement accompanying the decision the Bank noted that while heightened uncertainty in the global economy has decreased in recent weeks, global economic growth is likely to remain below trend. The Bank also noted that it expects Canadian households to add to their debt burden in 2012, which in the Bank's judgement is the biggest domestic risk to the Canadian economy. Finally,... Average Days on the Market and Price Per Square Foot for Apartments in VancouverBelow is a break down of the current Average Days on the Market (ADOM) and Average Price Per Square Foot for Apartments in and around Downtown Vancouver.

Housing Affordability Improves for Second Consecutive Quarter: RBC EconomicsModest Improvements at the End of 2011 Lighten the Load on Household BudgetsTORONTO, March 7, 2012— Canada's housing market made further steps on a promising path in the closing months of 2011 as affordability improved for the second consecutive quarter, according to the latest Housing Trends and Affordability Report released today by RBC Economics Research. Canadian homebuyers benefited from softer home prices and income gains that helped lighten the load on their budgets... Greater Vancouver housing market trends near long-term averages as spring market approachesCloser alignment between home buyer and seller activity helped bring greater balance to the Greater Vancouver housing market in February.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales in Greater Vancouver reached 2,545 on the MLS® system in February 2012. This represents a 61.4 per cent increase compared to the 1,577 sales recorded in January 2012, a decline of 17.8 per cent compared to the 3,097 sales in February 2011 and a 2.9... Canadian Real GDP Growth - BCREAThe Canadian economy grew 0.4 per cent in December and 1.8 per cent at a seasonally adjusted annual rate for the fourth quarter, close to BCREA’s forecast of 1.9 per cent and a marked decline from a 4.2 per cent rate of growth in the third quarter. Grwoth in Real GDP for 2011 was 2.5 per cent, a decline from 3.2 per cent growth in 2011. Significant uncertainty looms over the Canadian economy in 2012 from a yet unsettled Euro-debt crisis an improving but still sluggish US economy,... Information about the new HST | PST housing transitional rulesThe province will transition back to the Provincial Sales Tax (PST), which will replace the Harmonized Sales Tax (HST), on April 1, 2013. Until then, the province has announced transitional rules for new homes which take effect April 1, 2012.

Note: This information is current to today, February 21, 2012 and has been verified with the Canada Revenue Agency, HST Branch. However, we have been advised that the information could change depending on HST rulings to come.

For more... Home Sales Rise Outside Lower Mainland - BCREAVancouver, BC – February 15, 2012. The British Columbia Real Estate Association (BCREA) reports that the dollar volume of homes sold through Multiple Listing Service® (MLS®) in BC dipped 7.6 per cent to $2.1 billion in January compared to the same month last year. A total of 3,976 homes traded hands on the MLS® over the same period, down 3.9 per cent. The average MLS® residential price was 3.8 per cent lower at $527,219 compared to January 2011.

Selection broadens and demand eases to kick off 2012 in the Greater Vancouver housing marketGreater Vancouver home sellers were more active than buyers in January and overall home prices, according to the new MLS® Home Price Index (MLS® HPI), continued to experience more stability and less fluctuation compared to the beginning of 2011.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales in Greater Vancouver reached 1,577 on the Multiple Listing Service® (MLS®) in January 2012. This represents a 4.9 per cent decrease... Balanced real estate market prevailed through much of 2011The 2011 Greater Vancouver housing market began with heightened demand in regional hot spots and concluded with greater balance between seller supply and buyer demand. The Real Estate Board of Greater Vancouver (REBGV) reports that total sales of detached, attached and apartment properties in 2011 reached 32,390, a 5.9 per cent increase from the 30,595 sales recorded in 2010, and a 9.2 per cent decrease from the 35,669 residential sales in 2009. Last year’s home sale total was 6.3 per cent below... What $500,000 Gets You In: VancouverI wrote the following post for BMO SmartSteps - click here to view:

Consistently ranked as one of the very best cities to live in the World, living in Vancouver will unfortunately come at a price - it’s the trade-off for an incredible lifestyle. Price however, as we all know, is relative. From a Canadian perspective, Vancouver real estate prices may seem high, but not when compared to the global real estate market. To give you a taste of what you can buy in downtown Vancouver... Canada's Rental Vacancy Rate Decreases - CMHCBelow is an extract from the latest news release by Canada Mortgage and Housing Corporation (CMHC) about their fall Rental Market Survey. The average rental apartment vacancy rate in Canada's 35 major centres decreased slightly to 2.2 per cent in October 2011, from 2.6 per cent in October 2010, according to the fall Rental Market Survey released today by Canada Mortgage and Housing Corporation (CMHC).

“Modestly higher levels of employment among persons... Bank of Canada Interest Rate Announcement - BCREA ECONOMICS NOW As anticipated, the Bank of Canada maintained its target rate at 1 per cent this morning. On inflation, the Bank noted that it " expects the inflation rate to decline as a result of reduced pressures from food and energy prices and ongoing excess supply in the economy." The Bank expects a weaker external outlook and the ongoing sovereign debt crisis in Europe to dampen Canadian economic growth in the near future. Historically normal activity keeps the Greater Vancouver housing market in a balanced stateThe Greater Vancouver housing market saw relatively typical home sale and listing activity in November. The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales of detached, attached and apartment properties on the region’s Multiple Listing Service® (MLS®) reached 2,360 in November. This represents a 5.9 per cent decline compared to the 2,509 sales in November 2010 and a 1.9 per cent increase compared to the 2,317 sales recorded in October 2011. Looking... Canadian GDP Growth in Q3Canadian economic growth rebounded strongly in the third quarter of 2011 following a slight contraction in Q2. Real GDP data released this morning showed that the economy grew a robust 3.5 per cent last quarter, propelled higher by surging exports. However, domestic demand moderated as consumers and businesses reigned in spending.

Our forecast is for economic growth to slow in the fourth quarter and through much of 2012, likely to an average rate of between 1.5 and 2.5 per cent.... Housing Forecast Points to Market Stability in 2012: BCREA 2011 Fourth Quarter Housing ForecastVancouver, BC – November 8, 2011. The British Columbia Real Estate Association (BCREA) released its 2011 Fourth Quarter Housing Forecast today.

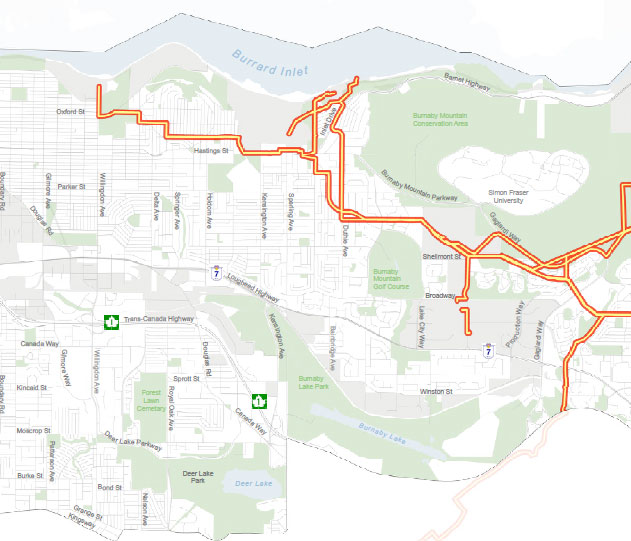

“Low mortgage interest rates are expected to persist through 2012 keeping affordability on an even keel,” said Cameron... Greater Vancouver at lower end of balanced housing marketWith a sales-to-active property listings ratio of 15 per cent, the Greater Vancouver housing market continues to hover at the lower end of a balanced market and has been trending in that direction over the past five months. The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales of detached, attached and apartment properties on the region’s Multiple Listing Service® (MLS®) system reached 2,317 in October, a 1 per cent decrease compared to the 2,337... What areas of Burnaby and the Tri-Cities are considered a Buyers Market?The following real estate statistics use the Sales-to-List ratio to determine which of the following areas are Buyers Markets. The stats also divide each area by product type. The areas include Burnaby, Port Moody, Coquitlam and Port Coquitlam. Click here to download stats package. BCREA on the Bank of Canada Interest Rate AnnouncementAs was universally anticipated, the Bank of Canada opted to hold its target overnight rate at 1 per cent this morning. Ongoing uncertainty in the Euro-zone continues to weigh heavily on the Bank's outlook. In its statement accompanying the interest rate decision, it was noted that the bank is now projecting a contained Euro-crisis, but also a brief recession in the Euro-area due to ongoing deleveraging and fiscal austerity. The Bank also expects continued weakness, but no recession,... Housing Starts - BCREA ECONOMICS NOWCanadian housing starts in increased in September, climbing to 7 per cent to a seasonally adjusted annual rate of 205,900 units. New home construction in BC also increased, rising 18.5 per cent from last month to a seasonally adjusted annual rate of 27,400 units. Total third quarter housing starts in BC were 6,844 compared with 6,316 starts in the third quarter of last year. New home construction continues to be centered around multi-family units which accounted for... Canadian House Price Rally Extended As Low Rates And Relatively Stable Domestic Economy Brace ConfidenceSoftening seen in some regions but suggestions of impending US-style correction unfounded, according to Royal LePage

The Royal LePage House Price Survey released today showed the average price of a home in Canada increased between 5.7 and 7.8 per cent in the third quarter of 2011, compared to the previous year. The strength of home price appreciation in the third quarter defied expectations as very low interest rates buoyed consumer confidence in a comparatively stable Canadian... |

Among its many provisions, it makes significant changes to legislation including the Canadian Environmental Assessment Act, the National Energy Board Act, and the Species at Risk Act.

Among its many provisions, it makes significant changes to legislation including the Canadian Environmental Assessment Act, the National Energy Board Act, and the Species at Risk Act..jpg) The Greater Vancouver housing market saw a slight increase in the number of home sales, a slight reduction in the number of listings, and a slight decrease in home prices in October compared to the summer months. With those changes, the sales-to-active-listings ratio increased to 11 per cent in October from 8 per cent in September.

The Greater Vancouver housing market saw a slight increase in the number of home sales, a slight reduction in the number of listings, and a slight decrease in home prices in October compared to the summer months. With those changes, the sales-to-active-listings ratio increased to 11 per cent in October from 8 per cent in September. BCREA 2012 Fourth Quarter Housing Forecast

BCREA 2012 Fourth Quarter Housing Forecast A laneway house (also known as a coach house or carriage house) is a detached dwelling located typically in the area where the garage would be on a single-family lot. It faces the lane, while maintaining the backyard open space. Alternatively on a corner lot it would face the side street. At least one parking space is needed for each laneway home. Most laneway houses include a garage.

A laneway house (also known as a coach house or carriage house) is a detached dwelling located typically in the area where the garage would be on a single-family lot. It faces the lane, while maintaining the backyard open space. Alternatively on a corner lot it would face the side street. At least one parking space is needed for each laneway home. Most laneway houses include a garage. Vancouver, BC - October 15, 2012. The British Columbia Real Estate Association (BCREA) reports that the dollar volume of homes sold through the Multiple Listing Service® (MLS®) in BC declined 28.5 per cent to $2.2 billion in September compared to the same month last year. A total of 4,539 MLS® residential unit sales were recorded over the same period, down 24.3 per cent from September 2011. The average MLS® residential price was $494,213, down 5.6 per cent from a year...

Vancouver, BC - October 15, 2012. The British Columbia Real Estate Association (BCREA) reports that the dollar volume of homes sold through the Multiple Listing Service® (MLS®) in BC declined 28.5 per cent to $2.2 billion in September compared to the same month last year. A total of 4,539 MLS® residential unit sales were recorded over the same period, down 24.3 per cent from September 2011. The average MLS® residential price was $494,213, down 5.6 per cent from a year... Home sale activity remained below long-term averages in the Greater Vancouver housing market in August.

Home sale activity remained below long-term averages in the Greater Vancouver housing market in August. The trend in the CLI continues to signal strong growth in the BC commercial...

The trend in the CLI continues to signal strong growth in the BC commercial... BC Multiple Listing Service® (MLS®) residential sales are forecast to edge down 2.2 per cent to 74,800 units this year, before increasing 4.9 per cent to 78,500 units in 2013. Since 2009, annual home sales in the province have hovered in the 74,000 to 78,000 unit range. A record 106,300 MLS® residential sales were recorded in 2005.

BC Multiple Listing Service® (MLS®) residential sales are forecast to edge down 2.2 per cent to 74,800 units this year, before increasing 4.9 per cent to 78,500 units in 2013. Since 2009, annual home sales in the province have hovered in the 74,000 to 78,000 unit range. A record 106,300 MLS® residential sales were recorded in 2005.

Vancouver, BC – March 15, 2012. The British Columbia Real Estate Association (BCREA) reports that the dollar volume of homes sold through Multiple Listing Service® (MLS®) in BC declined 9.6 per cent to $3.4 billion in February compared to the same month last year. A total of 5,923 MLS® residential unit sales were recorded over the same period, a decline of 7.6 per cent. The average MLS® residential price was $574,975 in February, 2.1 per cent lower than in February 2011.

Vancouver, BC – March 15, 2012. The British Columbia Real Estate Association (BCREA) reports that the dollar volume of homes sold through Multiple Listing Service® (MLS®) in BC declined 9.6 per cent to $3.4 billion in February compared to the same month last year. A total of 5,923 MLS® residential unit sales were recorded over the same period, a decline of 7.6 per cent. The average MLS® residential price was $574,975 in February, 2.1 per cent lower than in February 2011. "Increased market activity...

"Increased market activity... BC Multiple Listing Service® (MLS®) residential sales are forecast to rise 3.2 per cent from 74,640 units in 2010 to 77,000 units this year, increasing a further 3.9 per cent to 80,000 units in 2012.

BC Multiple Listing Service® (MLS®) residential sales are forecast to rise 3.2 per cent from 74,640 units in 2010 to 77,000 units this year, increasing a further 3.9 per cent to 80,000 units in 2012.