Typically, spring marks the peak activity season for Canada's real estate sector, as warmer weather prompts a surge in buying and selling nationwide. However, in 2024, this bustling spring market began earlier than usual and is experiencing added pressure. Aspiring homebuyers, who had been waiting on the sidelines, are now reentering the market ahead of anticipated interest rate cuts. This rush is expected to intensify competition and drive home prices even higher.

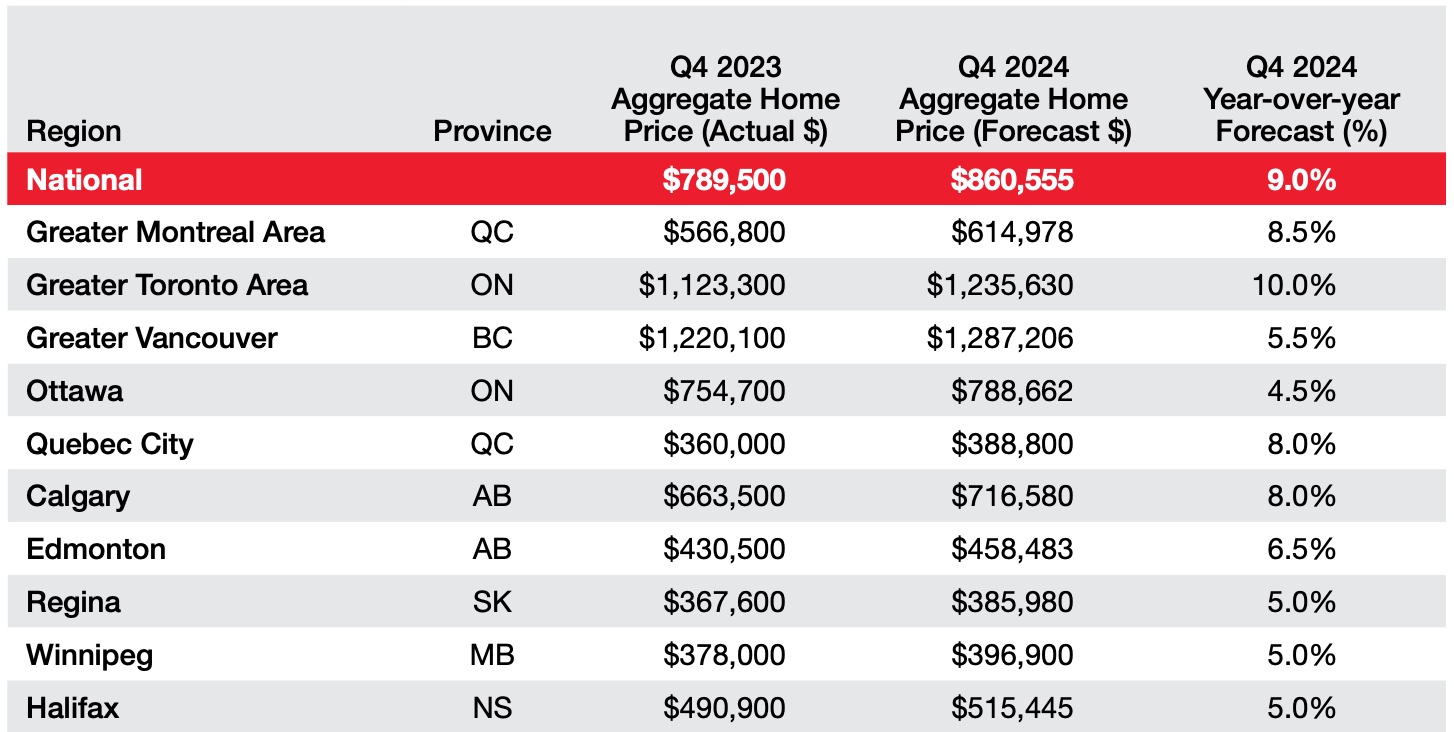

Royal LePage® projects that the overall price of homes in Canada will rise by 9.0% in the fourth quarter of 2024 compared to the same period in the previous year. This forecast has been revised upwards nationally and in most major markets, following robust first-quarter results.

Phil Soper, president and CEO of Royal LePage, remarked that the market hit a turning point in the first quarter of 2024, with home prices rebounding after bottoming out. He noted a shift in buyer behavior, with more people motivated to purchase homes sooner to avoid rising prices, rather than waiting for mortgage rates to decrease.

In the first quarter, the aggregate home price in Canada increased by 4.3% year-over-year to $812,100. Quarter-over-quarter, the national aggregate price rose by 2.9%, indicating a resurgence in homebuying activity ahead of expected interest rate cuts.

Broken down by housing type, the median price of single-family detached homes increased by 4.5% year-over-year to $845,300, while condominium prices rose by 3.5% to $591,900.

Toronto and Montreal are anticipated to lead in home price appreciation, with forecasted increases of 10.0% and 8.5% year-over-year, respectively, outpacing Calgary, which was previously expected to see the highest price gains.

Soper suggested that sustained price appreciation could narrow the gap between Toronto and Vancouver, with Toronto expected to surpass Vancouver's home prices in the latter half of 2024.

The Canadian housing market has already witnessed solid price appreciation and increased sales activity in the early months of the year. With the Bank of Canada holding rates steady since July 2023, many homebuyers are entering the market ahead of what they anticipate will be a highly competitive spring market, driving prices upward.

Looking ahead, Soper predicts a busy spring market leading into an even busier fall, signalling a shift away from a buyers' market to one favouring sellers. For more insights, refer to Royal LePage's first-quarter release.

First quarter press release highlights:

Among major regions, Calgary recorded highest year-over-year aggregate price appreciation (9.7%) for the second consecutive quarter; increased 1.9% on a quarterly basis

89% of regions in the report recorded quarterly price appreciation in the first three months of the year, ahead of the traditionally busy spring market period

Royal LePage expects home prices in the Greater Toronto Area will surpass those in Greater Vancouver in 2024

For the Greater Vancouver Press Release Click Here - Royal LePage

Comments:

Post Your Comment: