News: Vancouver Real Estate Market

Posted on

February 11, 2026

by

David Reimers

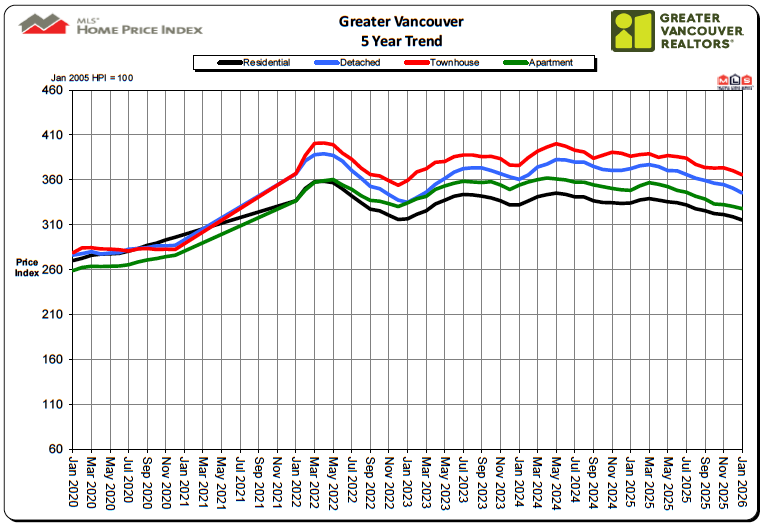

Last year’s market trends continued in January as home sales registered on the MLS® in Metro Vancouver* were 28.5% lower than last year, setting the year off to a quieter start. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 1,107 in January 2026, a 28.7% decrease from the 1,552 sales recorded in January 2025. This was 30.9% below the 10-year seasonal average (1,602). "On their own, the January sales appear alarming, but it’s important to put these figures...

Posted on

January 14, 2026

by

David Reimers

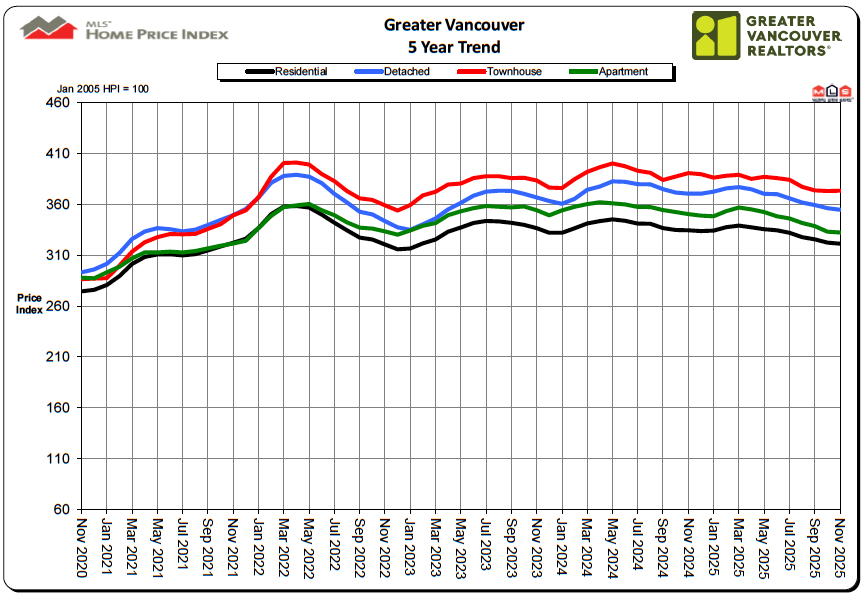

Home sales registered in the Multiple Listing Service® (MLS®) in Metro Vancouver* finished the year down 10%, marking the lowest annual sales total in over twenty years. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 23,800 in 2025, a 10.4% decrease from the 26,561 sales recorded in 2024, and a 9.3% decrease from the 26,249 sales in 2023. Last year’s sales total was 24.7% below the 10-year annual sales average (31,625). "This year was one for the history books....

Posted on

December 3, 2025

by

David Reimers

Metro Vancouver* home-sale trends observed in October continued in November, as sales registered on the MLS® remained lower than this time last year. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 1,846 in November 2025, a 15.4% decrease from the 2,181 sales recorded in November 2024. This was 20.6% below the 10-year seasonal average (2,324). "As the year draws to a close, the data continues telling a story of a market with many buyers patiently...

Posted on

November 7, 2025

by

David Reimers

Home sales registered on the MLS® in Metro Vancouver* were 14% lower than last October, as the trend of slower sales and building inventory creates favourable conditions for those looking to buy in the fall market. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 2,255 in October 2025, a 14.3% decrease from the 2,632 sales recorded in October 2024. This was 14.5% below the 10-year seasonal average (2,638). "October is typically the last month of the year...

Posted on

September 4, 2025

by

David Reimers

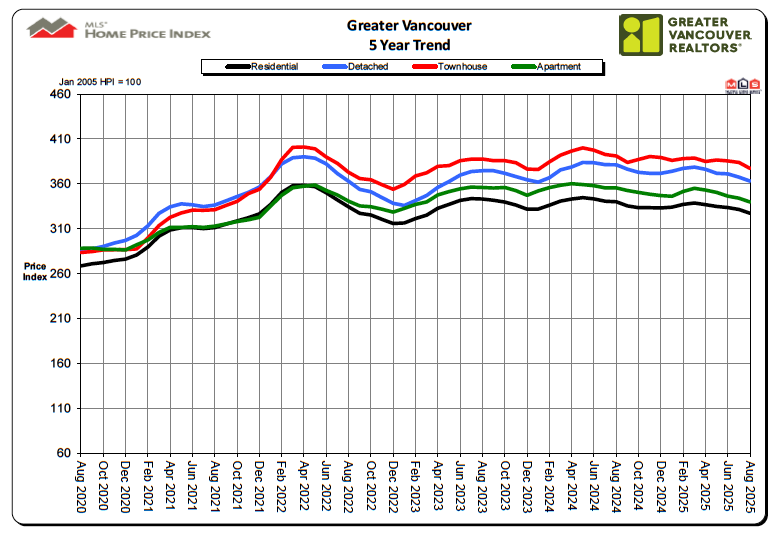

Easing prices brought more Metro Vancouver homebuyers off the sidelines in August, with home sales on the MLS® up nearly 3% from August last year. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 1,959 in August 2025, a 2.9% increase from the 1,904 sales recorded in August 2024. This was 19.2% below the 10-year seasonal average (2,424). “The August sales figures add further confirmation that sales activity across Metro Vancouver appears to...

Posted on

August 6, 2025

by

David Reimers

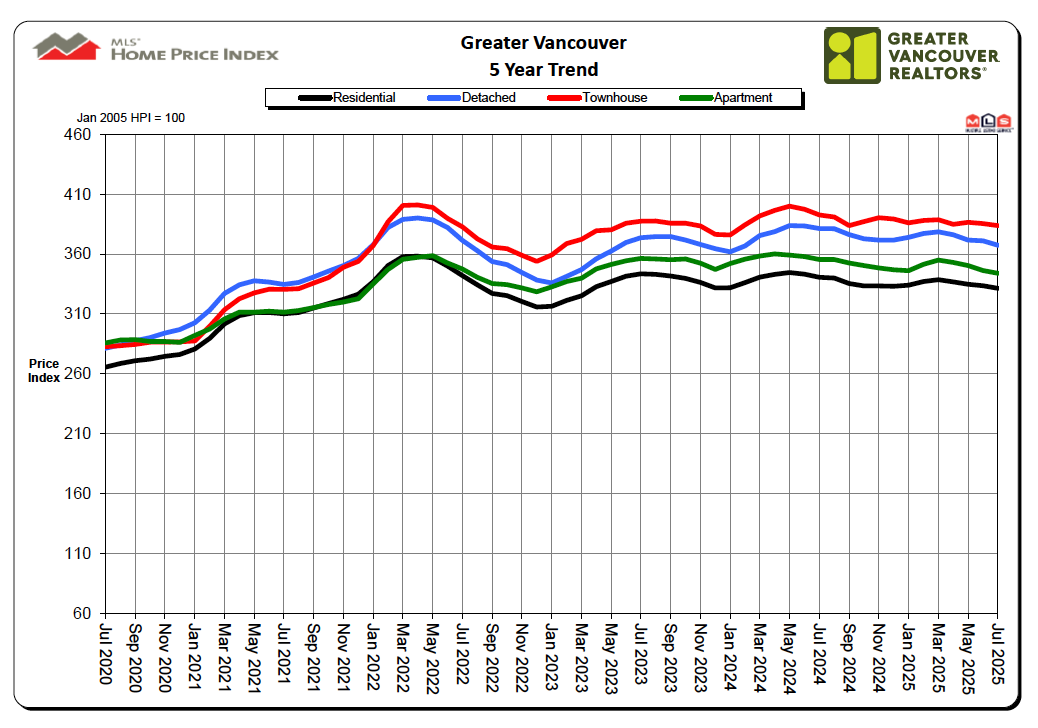

VANCOUVER - August 5, 2025 - Home sales registered on the MLS® across Metro Vancouver in July extended the early signs of recovery that emerged in June, now down just two per cent from July of last year. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 2,286 in July 2025, a 2% decrease from the 2,333 sales recorded in July 2024. This was 13.9% below the 10-year seasonal average (2,656). “The June data showed early signs of sales activity...

Posted on

May 15, 2025

by

David Reimers

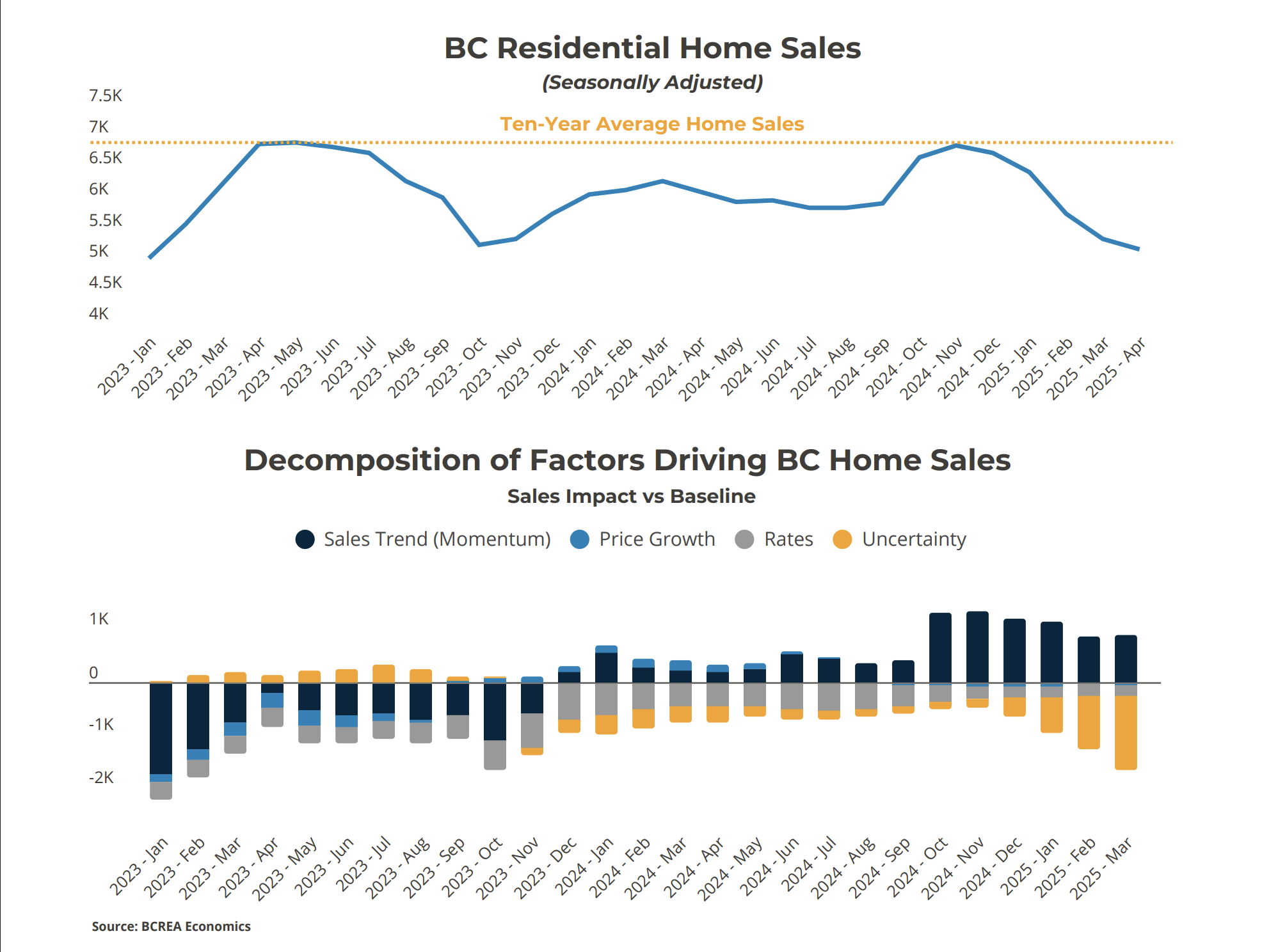

The BC housing market entered 2025 with a sense of optimism. After a slow couple of years, sales were finally rebounding, thanks to falling interest rates and pent-up demand. But just as momentum began to build, a new challenge emerged: uncertainty. Specifically, the uncertainty surrounding the United States’ unpredictable tariff policy under President Donald Trump has weighed heavily on households and businesses alike, and the housing market is no exception. How Uncertainty Is Impacting Home Sales...

Posted on

August 27, 2024

by

David Reimers

A recent survey reveals that 83% of adults in British Columbia, specifically those from Generation Z and younger Millennials aged 18 to 38 (born between 1986 and 2006), view homeownership as a valuable investment. Among those who don't currently own a home, 77% plan to purchase a primary residence during their lifetime. "Young Canadians have a strong positive outlook on owning real estate. Despite the challenges of entering urban markets like Vancouver, this demographic sees homeownership as a significant...

Posted on

February 15, 2024

by

David Reimers

The Canadian government has recently announced a two-year extension to the ban on foreign ownership of Canadian housing. This move reflects the government's commitment to ensuring that Canadians have access to affordable housing, promoting stability in the real estate market, and addressing concerns about the impact of foreign investment on housing prices. The decision to extend the ban comes in the wake of growing concerns about the role of foreign investors in the Canadian real estate market. In...

Posted on

December 14, 2023

by

David Reimers

Canadians may see the real estate market return closer to normal in 2024, after years of unprecedented irregularity. According to the Royal LePage Market Survey Forecast, the aggregate price of a home in Canada is set to increase 5.5 per cent year over year to $843,684 in the fourth quarter of 2024, with the median price of a single-family detached property and condominium projected to increase 6.0 per cent and 5.0 to $879,164 and $616,140. “Looking ahead, we see 2024 as an important tipping point...

Posted on

September 7, 2023

by

David Reimers

As we near the end of summer, higher borrowing costs have begun to permeate the Greater Vancouver housing market in predictable ways, with price gains cooling and sales slowing along the typical seasonal pattern.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 2,296 in August 2023, a 21.4 per cent increase from the 1,892 sales recorded in August 2022. This was 13.8 per cent below the 10-year seasonal average (2,663). ...

Posted on

July 14, 2021

by

David Reimers

Second quarter regional highlights:

- Aggregate price of a home in Canada rose 25.3% year-over-year in the second quarter

- Demand expected to outstrip supply with upward pressure on prices, yet the pace of increases should moderate as peak price appreciation was reached in early Q2

- Greater Montreal's aggregate home price forecast to increase 17.5% year-over-year; the highest in Canada among forecasted regions

- Detached house prices continue to outpace condo appreciation, but the gap is narrowing...

Posted on

October 6, 2020

by

David Reimers

Posted in

Attached Homes, BC Home Sales, BC Housing Market, BC Real Estate, Covid, Covid-19 House Price Survey, Detached Homes, Greater Vancouver, Greater Vancouver Market Updates, Home Buyers, Home Owners, Market Data, Metro Vancouver, MLS, Multiple Listing Service, Real Estate Board of Greater Vancouver, Real Estate Sales, Real Estate Statistics, REBGV, Statistics Package

In September 2020 the Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totaled 3,643. This is a 56.2% increase from the 2,333 sales recorded in September 2019 and a 19.6% increase from the 3,047 homes sold in August 2020.

"We've seen robust home sale and listing activity across Metro Vancouver throughout the summer months," Colette Gerber, REBGV Chair said. "This increased activity can be attributed, in part, to lower interest rates and changing housing...

Posted on

September 3, 2020

by

David Reimers

Posted in

Attached Home, BC Home Sales, BC Housing Market, BC Real Estate, Covid-19 Housing Market Update, Detached Home, Greater Vancouver, Greater Vancouver Market Updates, Home Buyers, Home owners, Market Data, Market Update, Metro Vancouver, MLS, Multiple Listing Service, Real Estate Board of Greater Vancouver, Real Estate Sales, Real Estate Statistics, REBGV, Statistics Package

In August 2020, residential home sales in the region totaled 3,047 according to the Real Estate Board of Greater Vancouver (REBGV). This is a 36.6% increase from the 2,231 sales recorded in August 2019 and a 2.6% decrease from the 3,128 homes sold in July 2020.

"People who put their home buying and selling plans on hold in the spring have been returning to the market throughout the summer," Colette Gerber, REBGV Chair said. "Like everything else in our lives these days, the uncertainty COVID-19 presents...

Posted on

August 12, 2020

by

David Reimers

Posted in

Attached Home, BC Home Sales, BC Housing Market, BC Real Estate, BCREA, British Columbia Real Estate Association, Covid-19 Housing Market Update, Detached Home, Greater Vancouver, Home Buyers, Home Owner, Market Data, Market Update, Metro Vancouver, MLS, Multiple Listing Service, Real Estate Sales, Real Estate Statistics, Statistics Package

In July 2020, the British Columbia Real Estate Association (BCREA) reported a total of 10,090 residential unit sales recorded by the Multiple Listing Service® (MLS®). This showed an increase of 26.6% from the same month last year. The average MLS® residential price in BC was $770,810, a 12.9% increase from $682,702 recorded the previous year. Total sales dollar volume in July was $7.8 billion, a 43% increase over 2019.

"The strong recovery in sales activity continued in July," said BCREA...

Posted on

August 4, 2020

by

David Reimers

Posted in

Attached Home, BC Home Sales, BC Housing Market, BC Real Estate, Cocid-19 Housing Market Update, Detached Home, Greater Vancouver, Home Buyers, Home Owner, Market Data, Market Update, Metro Vancouver, MLS, Multiple Listing Service, Real Estate Board of Greater Vancouver, Real Estate Sales, Real Estate Statistics, REBGV, Statistics Package

In July 2020, residential home sales in the region totaled 3,128 according to the Real Estate Board of Greater Vancouver (REBGV). This represents a 22.3% increase from the 2,557 sales recorded in July 2019 and a 28% increase from the 2,443 homes sold in June 2020.

"We're seeing the results today of pent up activity, from both home buyers and sellers, that had been accumulating in our market throughout the year," Colette Gerber, REBGV Chair said. "Low-interest rates and limited overall supply are also...

Posted on

July 5, 2020

by

David Reimers

Posted in

Attached Home, BC Home Sales, BC Housing Market, BC Real Estate, Covid-19 Housing Market Update, Detached Home, Greater Vancouver, Home Buyers, Home Owner, Market Data, Market Update, Metro Vancouver, MLS, Multiple Listing Service, Real Estate Board of Greater Vancouver, Real Estate Sales, Real Estate Statistics, REBGV, Statistics Package

Residential home sales in the region totalled 2,443 in June 2020 accroding to the Real Estate Board of Greater Vancouver (REBGV). This is a 17.6% increase from 2,077 sales recorded in June 2019 and a 64.5% increase from the 1,485 homes sold in May 2020.

"REALTORS® continue to optimize new technology tools and practices to help their clients meet their housing needs in a safe and responsible way," Colette Gerber, REBGV Chair said "Over the last three months, home buyers and sellers have become...

Posted on

April 20, 2020

by

David Reimers

Posted in

BC Home Sales, BC Housing Market, BC Provincial GDP, BCREA, British Columbia Real Estate Association, Canadian Economy, COVID-19 Economic Data, COVID-19 Recession, Economic Growth, Economic impact of COVID-19, Greater Vancouver, Home Owners, Interest Rates, Metro Vancouver, Residential Homes, Unemployment Rate

In the past 40 years, the Canadian economy has had three recessions, each of them different in cause, depth, and duration. The 2020 COVID-19 recession is said to be deep, but will not last long when compared to past recessions. The one glaring similarity throughout these recessions is how the BC housing market has both endured and recovered successfully.

According to the current forecast, the Canadian economy is said to contract approximately by 4% in the first quarter of 2020, followed by a startling...

Posted on

March 27, 2020

by

David Reimers

Posted in

Bank of Canada, BC housing market, BCREA, Canada mortgage rates, Credit markets, Effective lower bound, Financial plan, Funding, Interest rate, Interest rate change, Market statistics, Market update, mortgage payments, Programs, Reduction in rates, Short-term funding market

The Bank of Canada has lowered its overnight policy rate for the second time this month, taking the rate down a further 50 basis points to 0.25%. This is what the Bank considers as its effective lower bound and any further reduction in rates is not possible without potentially disrupting key short-term funding markets.

In addition, two new programs have been announced to ensure the continued smooth running of credit markets and to promote credit availability. First, the Commercial Paper Purchase Program...

Posted on

March 24, 2020

by

David Reimers

Posted in

2020 market report, Bank of Canada, BC housing market, bcrea, British Columbia Real Estate, covid-19, covid-19, economic data, Economic impact of COVID-19, Impact of COVID-19, Interest rates, low mortgage rates, Mortgage payments, Mortgage rate, Real estate market forecast, real estate transaction, stress test

The COVID-19 outbreak has caused a steep decline in interest rates, however, it is uncertain as to how severe the impact will be on economic activity. Considering the importance of tourism and our trade links with China, the magnitude of the impact is expected to be higher in BC. In addition, the Canadian economy also saw the collapse of oil prices and this makes the probability of a recession in Canada that much higher.

An unfortunate byproduct of recession is the loss of jobs and incomes, which...

|