News: Vancouver Real Estate Market

Posted on

March 5, 2025

by

David Reimers

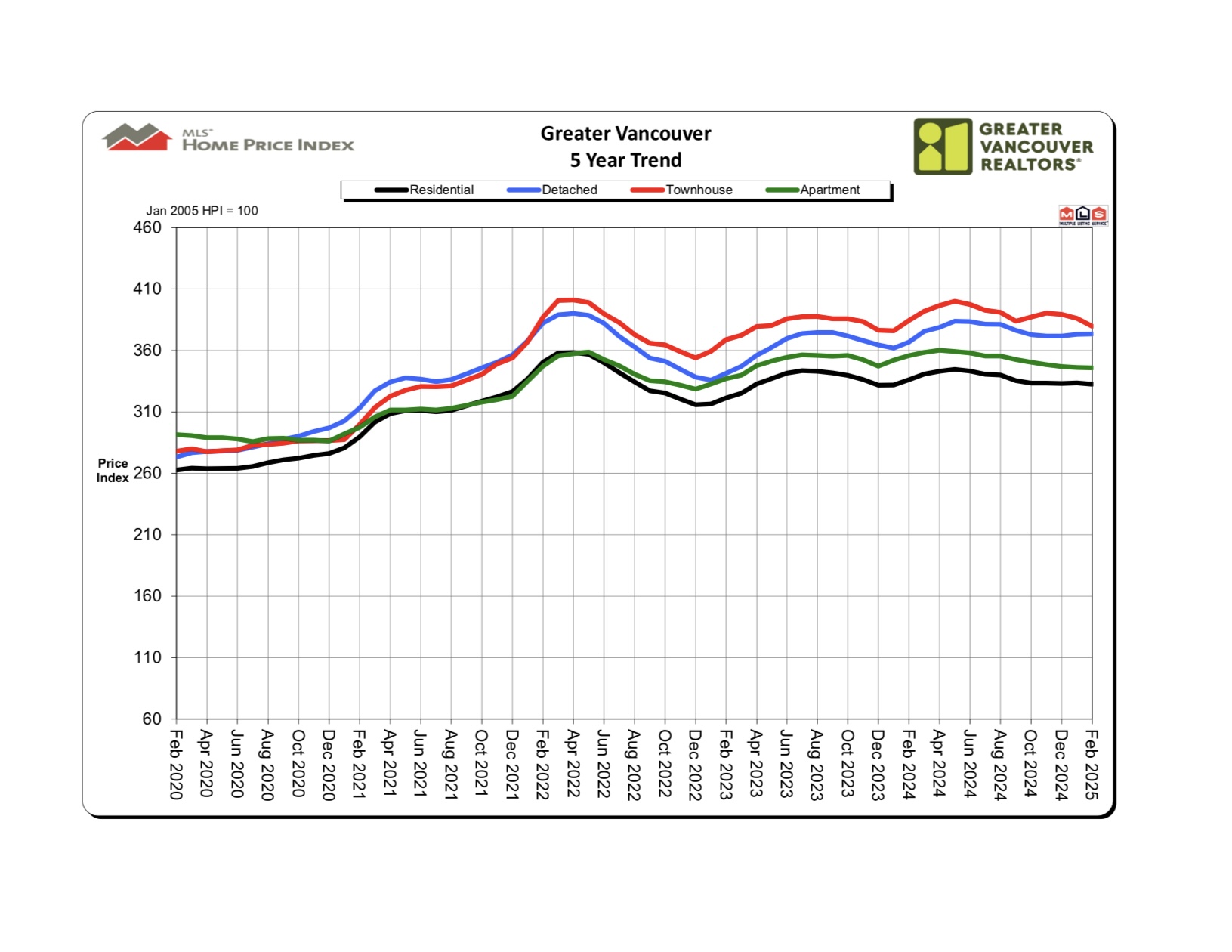

The number of newly listed properties on the MLS® in Metro Vancouver rose more moderately in February, after a 46% year-over-year increase of new listings in January, helping keep market conditions in balanced territory.

The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 1,827 on Metro Vancouver’s Multiple Listing Service® (MLS®) in February 2025, an 11.7% decrease from the 2,070 sales recorded in February 2024. This total was 28.9% below the 10-year seasonal...

Posted on

January 6, 2025

by

David Reimers

Posted in

december sales, Greater Vancouver, greater vancouver house prices, greater vancouver housing market, Greater Vancouver Market Forecast, Greater Vancouver Market Updates, Greater Vancouver Real Estate Market, Greater Vancouver real estate market update, greater vancouver realtors, Home Evaluation, home sales, market report, Metro Vancouver Real Estate

Home sales registered on the Multiple Listing Service® (MLS®) in Metro Vancouver increased over 30 % in December, compared to the previous year, signaling strengthening demand-side momentum to close-out the year. The Greater Vancouver REALTORS® (GVR) reports that regional residential sales totaled 26,561 in 2024, a 1.2 % rise from 26,249 sales in 2023, and a 9.2 % decrease from the 29,261 sales in 2022. The total of last year’s sales was 20.9 % below the 10-year annual sales average of 33,559....

Posted on

August 2, 2024

by

David Reimers

Posted in

2024 Market Report, Greater Vancouver, greater vancouver house prices, greater vancouver housing market, Greater Vancouver Market Forecast, Greater Vancouver Market Updates, greater vancouver real estate, Greater Vancouver Real Estate Market, Greater Vancouver real estate market update, greater vancouver realtors, Home Evaluation

Newly listed properties registered on the Multiple Listing Service® (MLS®) rose nearly 20% year over year in July, helping to maintain a healthy level of inventory in the Metro Vancouver housing market. On the demand side, the Greater Vancouver REALTORS®2 (GVR) reports that residential sales in the region totalled 2,333 in July 2024, a 5% decrease from the 2,455 sales recorded in July 2023. This was 17.6% below the 10-year seasonal average (2,831). “The trend of buyers remaining hesitant, that...

Posted on

June 5, 2023

by

David Reimers

While the year started slower than usual, Metro Vancouver’s1 housing market is showing signs of heating up as summer arrives, with prices increasing for the sixth consecutive month. The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 3,4112 in May 2023, which is a 15.7 per cent increase from the 2,947 sales recorded in May 2022, and a 1.4 per cent decline from the 10-year seasonal average (3,458). "Back in January, few people would have predicted...

Posted on

January 20, 2023

by

David Reimers

According to the Royal LePage House Price Survey released today, the aggregate price of a home in Canada decreased 2.8 per cent year-over year to $757,100 in the fourth quarter of 2022; the first year-over-year decline recorded since the end of 2008 during the global financial crisis. On a quarter-over-quarter basis, the aggregate price of a home in Canada decreased 2.3 per cent. This is the third consecutive quarterly decline, and the smallest decrease so far.

In December, Royal...

Posted on

October 5, 2021

by

David Reimers

Home sale activity remains elevated across Metro Vancouver's housing market while the pace of homes being listed for sale continues to follow long-term averages. The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 3,149 in September 2021, a 13.6 % decrease from the 3,643 sales recorded in September 2020, and a 0.1 % decrease from the 3,152 homes sold in August 2021. Last month's sales were 20.8 % above the 10-year September...

Posted on

March 9, 2019

by

David Reimers

A quick follow-up to last month's issue when I chose to focus on the primary reason for the current buyer's market, which generally is attributed to the B-20 mortgage stress test that the federal government’s banking regulator (OSFI) imposed.

In the interest of time and realizing most of my audience are busy with limited time to read a lengthy explanation on all the reasons, I chose to focus on the "primary" reason - which is by no means the only reason. Obviously the Feds had their reasons...

|