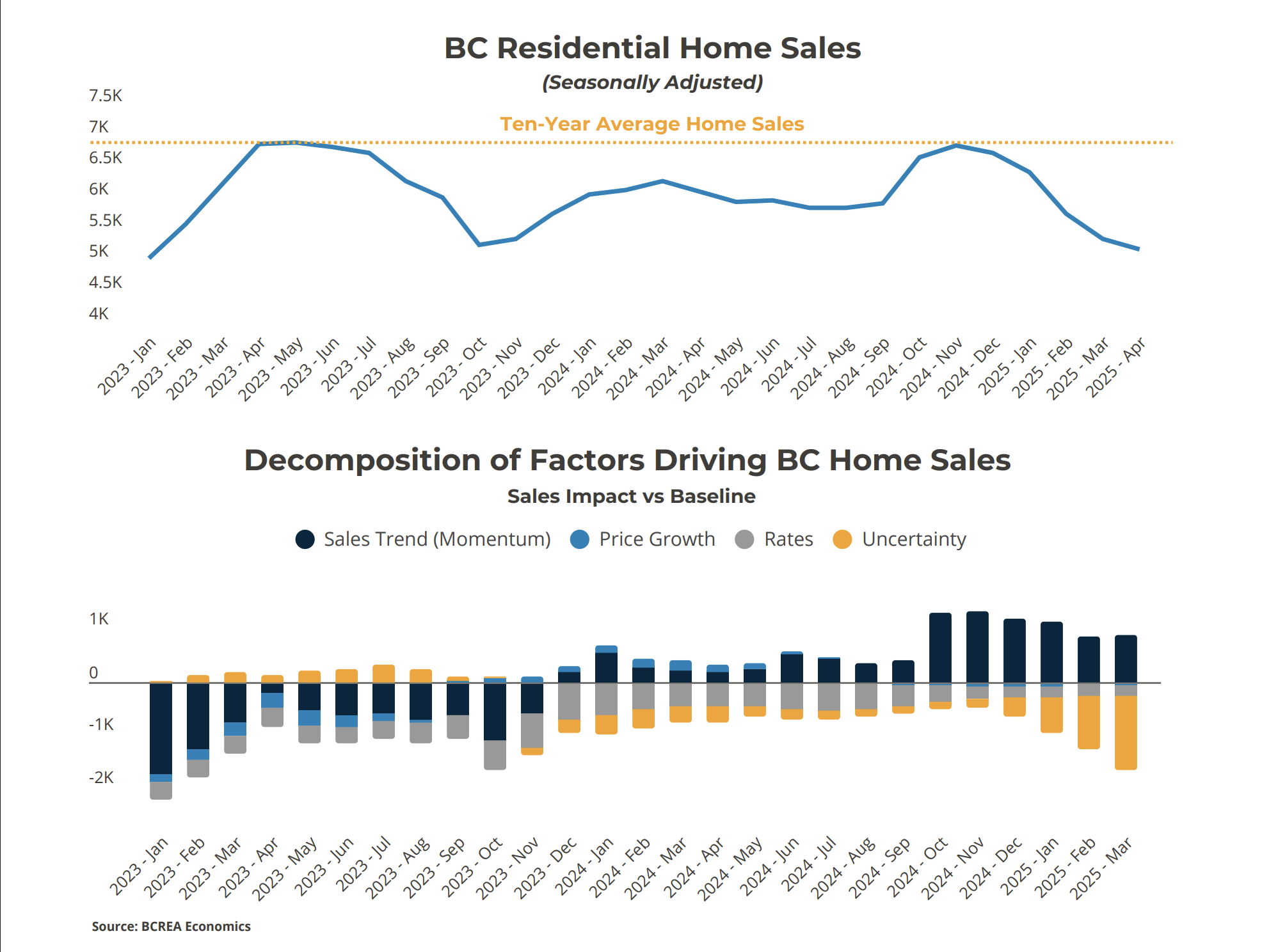

The BC housing market entered 2025 with a sense of optimism. After a slow couple of years, sales were finally rebounding, thanks to falling interest rates and pent-up demand. But just as momentum began to build, a new challenge emerged: uncertainty.

Specifically, the uncertainty surrounding the United States’ unpredictable tariff policy under President Donald Trump has weighed heavily on households and businesses alike, and the housing market is no exception.