News: Vancouver Real Estate Market

Posted on

May 2, 2024

by

David Reimers

Active home listings on the MLS® in Metro Vancouver continued to rise in April, showing a 42% year-over-year increase, surpassing the 12,000 mark—a level last observed in the region during the summer of 2020. Greater Vancouver REALTORS® (GVR) report that residential sales in the area totaled 2,831 in April 2024, marking a 3.3% increase from the 2,741 sales recorded in April 2023. However, this figure was 12.2% below the 10-year seasonal average of 3,223. “It’s a feat to see inventory finally climb above...

Posted on

October 4, 2022

by

David Reimers

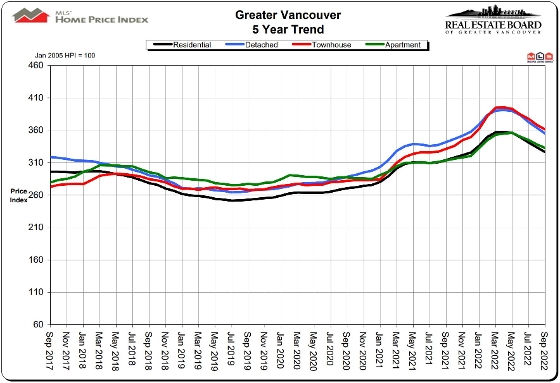

Home sellers were more active in Metro Vancouver's housing market in September while home buyer demand remained below the region's long-term averages.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 1,687 in September 2022, a 46.4% decrease from the 3,149 sales recorded in September 2021, and a 9.8% decrease from the 1,870 homes sold in August 2022.

Last month's sales were 35.7% below the 10-year September sales average.

"With the Bank...

Posted on

April 24, 2020

by

David Reimers

Posted in

2020 Market Report, Aggregate Home Price, Canada Home Prices, City of Vancouver, Condominium, COVID-19 impact on home prices, First Quarter, Greater Vancouver, Greater Vancouver Housing, Home Price, Market Forecast, Market Statistics, Metro Vancouver, Real Estate Sales, Residential Homes, RLP Market Forecast, Royal LePage Market Forecast

Canada's aggregate home prices are predicted to grow 1% by the end of 2020 in a best-case scenario. If the restrictions remain in place through late summer, a national home price decrease of 3% is expected by the end of 2020. In the first quarter of 2020, the aggregate home price in Canada climbed 4.4% year-over-year.

Where does Greater Vancouver stand in all of this?

During the first quarter of 2020, the aggregate price of a home in Greater Vancouver decreased by 2.1% year-over-year to $1,083,166...

Posted on

April 14, 2020

by

David Reimers

Posted in

Aggregate Home Price, Aggregate Price, Attached Homes, BC Home Sales, Canadian Economy, Covid-19 House Price Survey, Detached House, Economic impact of COVID-19, Greater Vancouver, Greater Vancouver Housing, Home Owners, Market Data, Market Statistics, Real Estate Analysis, Real Estate Statistics, Royal LePage House Price Survey

According to the Royal LePage House Price Survey and Market Survey Forecast released today, if the strict stay-at-home restrictions are eased during the second quarter Canada's aggregate home price could grow a modest 1% by the end of 2020, to $653,800. If the restrictions on personal movement continues through summer, the home prices to go down by 3%, to $627,900 year-over-year.

"The impact of COVID-19 on the Canadian economy has been swift and violent, with layoffs driving high levels of unemployment...

Posted on

March 27, 2020

by

David Reimers

Posted in

Bank of Canada, BC housing market, BCREA, Canada mortgage rates, Credit markets, Effective lower bound, Financial plan, Funding, Interest rate, Interest rate change, Market statistics, Market update, mortgage payments, Programs, Reduction in rates, Short-term funding market

The Bank of Canada has lowered its overnight policy rate for the second time this month, taking the rate down a further 50 basis points to 0.25%. This is what the Bank considers as its effective lower bound and any further reduction in rates is not possible without potentially disrupting key short-term funding markets.

In addition, two new programs have been announced to ensure the continued smooth running of credit markets and to promote credit availability. First, the Commercial Paper Purchase Program...

Posted on

February 24, 2020

by

David Reimers

The median prices of luxury homes in Greater Vancouver decreased by 6.7% year-over-year to $5,394,594 during the twelve-month period ending January 31, 2020. There was also a deacrese of 4.4% in Luxury apartment-style condominiums to $2,411,773.

Greater Vancouver luxury homes were showing year-over-year declines in median prices for both houses and condominiums over the twelve-month period. Since October 2019, a significant boost in luxury unit sales were observed and this is moving the market towards...

Posted on

January 16, 2020

by

David Reimers

What does it mean for B.C.?

The Greater Vancouver market saw signs of heading towards recovery in the fourth quarter, after a year-over-year decline. There was a 4.8% decrease in the aggregate price of a home in Greater Vancouver year-over-year to hit $1,107,719 in the fourth quarter of 2019. The aggregate price of a home in the third quarter of 2019, had decreased 5.2% compared to the same time last year.

Greater Vancouver's real estate market was fairly balanced in the fourth quarter according to...

Posted on

December 12, 2019

by

David Reimers

Posted in

BC Home Sales, Coquitlam Home Sales, Greater Vancouver, Greater Vancouver Home Sales, Home Owners, Market Prices, Market Statistics, Metro Vancouver, Real Estate Market, Reimers Group, Royal LePage Market Forecast, Tri-Cities Real Estate Market

What does this mean for us?

Greater Vancouver house prices will see a stabilization in 2020. The aggregate prices for homes is forecasted to hit $1,125,200, an increase if 1.5% in 2020. For two-storey homes the prices are expected to rise to $1,460,700, a rise of 1.25% year-over-year. Median prices for condominiums is also said to rise to $666,900, a 3.0% increase by the end of next year.

According to Randy Ryalls, Managing Broker, Royal LePage Sterling Realty, "Sales have picked up significantly...

Posted on

December 10, 2019

by

David Reimers

Posted in

bc home sales, BCREA, Best Rated Realtor, Coquitlam MLS home prices, Greater Vancouver, market statistics, Metro Vancouver, Multiple Listing Service, Real Estate Sales, Real Estate Services, Top Agent, Tri-Cities Real Estate Market

According to the British Columbia Real Estate Association (BCREA) report, there were 6,616 residential unit sales recorded by the Multiple Listing Service® (MLS®) in November. This showed an increase of 27.5% from the same month last year. The MLS® recorded an average residential price in the province at $746,939, an increase of 5.5% from November 2018. The total sales volume saw a 34.4% increase to reach $4.94 billion, compared to the same month last year.

"After several months of strong...

Posted on

November 13, 2019

by

David Reimers

According to the British Columbia Real Estate Association (BCREA), residential unit sales totalled 7,666 as recorded by the Multiple Listing Service® (MLS®) in October. This is an increase of 19.3% from the same month last year. The average MLS® residential price in the province increased 5.1% from October 2018, at $724,045. Total sales were also up by 25.4% at $5.55 billion, from the same month last year.

"Most markets around the province are returning to a more typical level of sales...

Posted on

November 6, 2019

by

David Reimers

According to the Multiple Listing Service® (MLS®)forecast, residential sales in the province are to decline 1.8% to about 77,100 units this year, compared to 78,505 residential sales in 2018. Residential sales on MLS® are forecast to increase 10.9% in 2020 and hit 85,500 units, just below the 10-year average for MLS® residential sales of 85,800 units.

"After a slow start to 2019, MLS® home sales in BC have embarked on a sustained upward trend since the spring," said Brendon Ogmundson,...

Posted on

June 4, 2019

by

David Reimers

Posted in

Buying in BC, Coquitlam, Coquitlam Houses for Sale, coquitlam real estate agent, David Reimers, Housing starts, market statistics, Metro Vancouver, real estate, Real Estate Agent, Reimers Group, Selling your home, vancouver real estate, Vancouver Real Estate Market

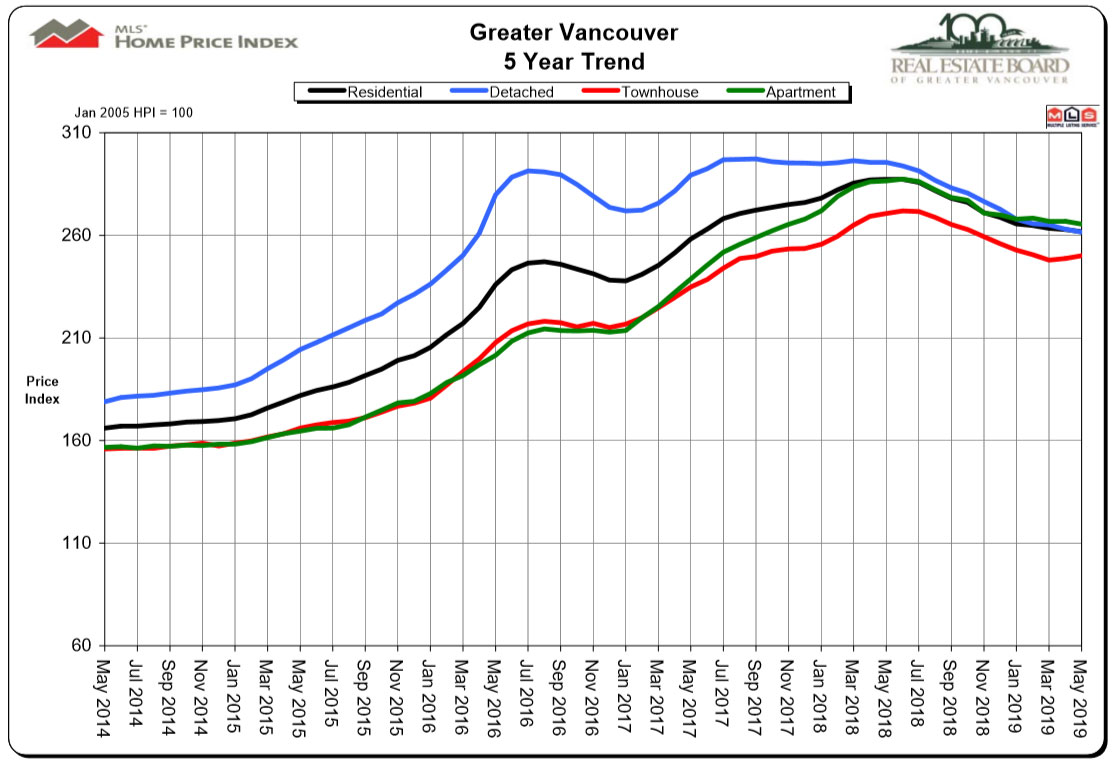

Metro Vancouver home sales exceed 2,000 for the first time in 2019, while buyer demand remains below averages.

The Real Estate Board of Greater Vancouver (REBGV) reports residential sales in Metro Vancouver area totaled 2,638 in May 2019, a 44.2% increase from the 1,829 homes sold in April 2019.

"High home prices and mortgage qualification issues caused by the federal government’s B20 stress test remain significant factors behind the reduced demand that the market is experiencing today," Ashley...

|