Canada’s national housing market is shifting toward a more sustainable path, though significant differences in regional conditions continue.

Canada’s national housing market is shifting toward a more sustainable path, though significant differences in regional conditions continue.

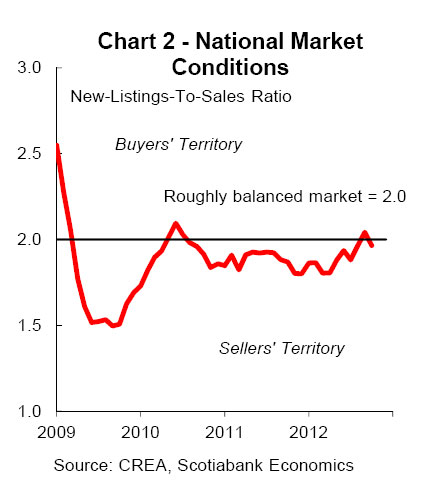

Canada’s housing market so far appears to have achieved a soft landing, with cooler but fairly steady sales and pricing through the fall. Nationally, sales in October were down about 10% from strong spring levels, but are only marginally below the average pace of the past decade. Early reports for November point to more of the same.

The moderation in activity mirrors a modest softening in labour market conditions over the summer, and piggybacks on repeated warnings from policymakers to moderate the pace of household debt accumulation. At the same time, high and rising home prices combined with consecutive rounds of tightening in mortgage insurance rules in recent years have contributed to a deterioration in housing affordability, most notably for first-time buyers. The latest round of regulatory changes that took effect in early July, including the lowering of the maximum amortization period from 30 to 25 years, has contributed to the softening but does not appear to have sharply accelerated the decline. Meanwhile, anecdotal reports point to a lower level of investor and/or foreign demand.

Click Canada's Housing Market - Scotiabank for more information.

Comments:

Post Your Comment: