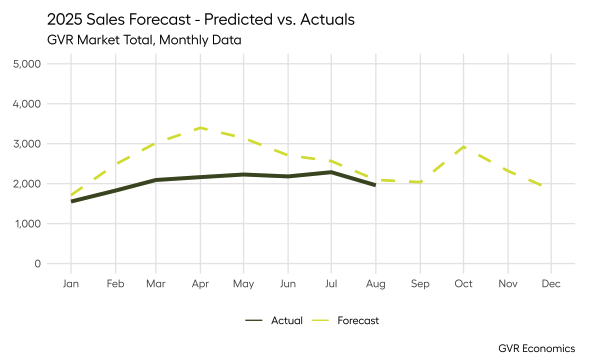

Home sales in the first half of the year were much slower than our H1 forecast had anticipated.

While it's difficult to pin the blame entirely on the economic uncertainty arising from the tariff-related policies of the new US administration, it's also difficult to say these developments have had no effect either.

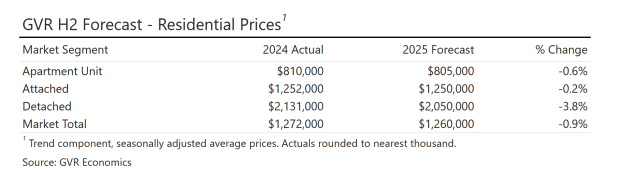

And despite home prices having eased since the start of the year, in addition to three Bank of Canada interest rate cuts, buyers have remained hesitant to re-enter the market.

Our H2 forecast takes stock of these dynamics and presents a revised outlook for the second half of the year.

Key Highlights

Home sales have lagged well below seasonal and long-term averages for most of the first half of the year, while resale inventory has climbed to highs not seen in over a decade.

Home prices have trended down modestly since the start of the year, and the Bank of Canada has cut the policy three times since the start of the year. This has materially improved affordability in the market, but not sufficiently to encourage many buyers sitting on the sidelines back into the market.

A further cut to the policy rate is expected by the Bank of Canada by year end, but the current trajectory of sales is unlikely to be able to make up the ground lost in the first half of the year, by year-end.

Typically, the first half of the year is marked by heightened activity, with buyers and sellers participating in the busy spring market.

But the sluggish sales trend observed in the first quarter persisted throughout the first half of 2025, with sales remaining below their long term averages, and well below seasonal norms.

It was clear that something was amiss in the market, and whatever it was appeared to be keeping buyers on the sidelines.

Sellers by contrast, remained eager to list their properties throughout the first half of the year, bringing standing inventory to heights not seen in over a decade.

The table below provides a breakdown of the price forecasts by market segment:

Summary of Risks to the Forecast

Below, we provide a summary of reasonably foreseeable risks to the forecast at the time of publication:

Downside risks

Sales could slow more significantly than forecast if the economy heads into recession, increasing unemployment, thereby reducing demand among potential buyers.

Sales could experience an acute downside shock as a result of new tariffs imposed on Canadian exports to the USA, though we continue to expect any such effects to be short-lived.

Valuations could be lower than forecast if a recession is accompanied by significant job losses, eliminating pools of buyers who otherwise may have participated in the market.

Upside risks

Sales activity and valuations could be higher than forecast if borrowing costs fall more than expected. This might occur in response to a domestic recession, or to offset anticipated negative shocks to the economy from further threats of tariffs imposed on Canada by the USA.

Inventory levels could recede more quickly from their currently elevated state, which may lead to modest price appreciation by year end. It remains unlikely that price appreciation by year end would be greater than our H1 forecast estimates, however.

Comments:

Post Your Comment: