REBGV Market Activity – June 2023

The Greater Vancouver real estate housing market is showing some conflicting indicators, suggesting a potential shift on the horizon. While the REBGV aggregate HPI benchmark price rose to $1,203,000, the overall average sales price experienced a decline, marking the first decrease since January. In June, the aggregate average property value decreased by $41,275, resulting in a final price of $1,270,619. However, when compared to the previous year, average sale prices have still seen a significant increase of $52,182.

The overall inventory has been slowly increasing, with 9,327 active listings at the end of June. This figure represents the lowest total for June since 2017, leading to increased competition among buyers for the limited available properties. Despite the low inventory, sales are still occurring rapidly, with properties selling in an average of just 22 days in June. The number of active listings remains well below the monthly 10-year average, currently sitting 29% lower than historical levels. The market absorption rate remains strong, with 32% of available listings being sold in June, and properties achieving a sales price of 100.2% of the list price.

As the summer months begin, the Greater Vancouver market remains active. Home sales have experienced a surge of over 500 sales compared to June 2022. Multiple offers are still prevalent, leading to sale prices surpassing the initial asking prices for the first time since May 2022. Despite a 0.25 basis point interest rate increase in June, sales have remained at historical levels, with only a 7% decrease compared to the average June data of the preceding 10 years. Buyers who have already secured pre-approved mortgages are likely to take advantage of their rate hold and make their purchases before the rate hold expires. However, rising interest rates are expected to have a temporary negative impact on the housing market, as noted by Phil Soper, President and CEO of Royal LePage. “Rising rates have an oversized psychological impact on people buying and selling properties in this country, and so it will create a small stall in the market,” Soper said.

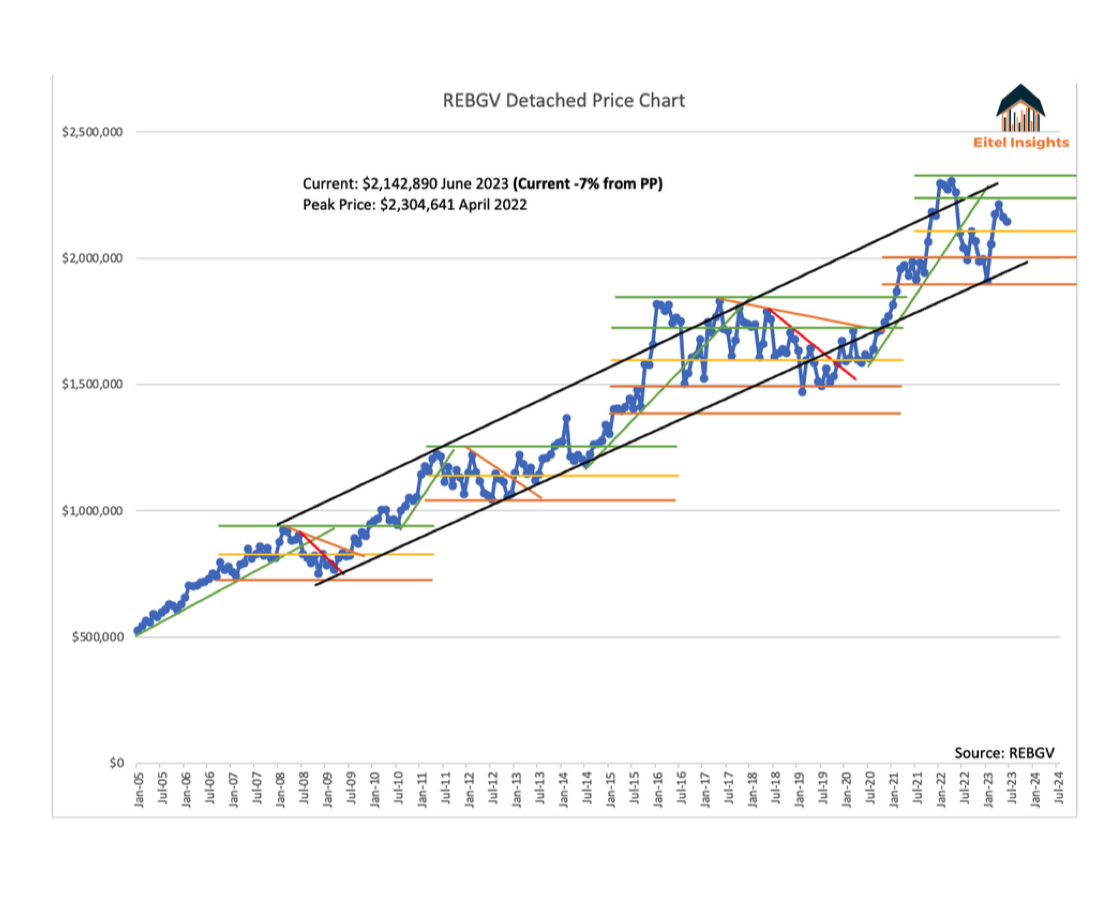

When examining individual asset classes, the townhouse market saw a monthly increase in the average sales price of $5,926, while both the detached and condo markets experienced minor declines of $20,263 and $8,752, respectively. Interestingly, on a year-over-year basis, the detached and condo markets have shown increases of $43,971 and $29,209, while the townhouse market remains slightly below its value from the previous year by only $1,943. Comparing current average sales prices to the market highs of 2022, condos have experienced a 4% decrease, townhouses are down by 5%, and detached properties have decreased by 7%.

It is important to note that real estate investment is a long-term endeavour, and when compared to values five years ago, the market still presents appealing opportunities for investors. Detached properties have appreciated by $384,239, townhomes by $273,452, and condos by $119,157.

Despite housing affordability concerns and the NDP provincial government's efforts to streamline new development processes, properties have not found their way to the open market. “Under the NDP government’s new Housing Supply Act, the province announced housing targets for 10 municipalities, but a government order-in-council later revealed that 47 municipalities would likely have to ramp up production of housing. The first batch included Vancouver, North Vancouver, Delta, Port Moody, Kamloops, Abbotsford, Victoria, Oak Bay, Saanich and West Vancouver. Targets will be announced later in the summer and municipalities will have six months to show they’re making progress.”

While development projects aim to address housing challenges, the resale inventory has been steadily increasing for seven consecutive months. The detached market leads with 4,062 active listings, followed by condos with 3,874 listings, and townhouses with 998 listings. Although inventory has been increasing, the overall level of active properties remains low compared to historical standards. The 10-year monthly average for active listings during June is 13,060, while the current available listings stand at 9,327, representing a decrease of 29% compared to the historical average.

Despite the persistent struggles with inventory, buyers remain highly active, particularly in the attached asset classes. In terms of absorption rates, townhouses exhibit the strongest performance with a rate of 47%, followed by condos at 41%, and detached properties at 21%. Andrew Lis, REBGV's director of economics and data analytics, noted “The market continues to outperform expectations across all segments, but the apartment segment showed the most relative strength in June."

Comments:

Post Your Comment: