The BC housing market entered 2025 with a sense of optimism. After a slow couple of years, sales were finally rebounding, thanks to falling interest rates and pent-up demand. But just as momentum began to build, a new challenge emerged: uncertainty.

Specifically, the uncertainty surrounding the United States’ unpredictable tariff policy under President Donald Trump has weighed heavily on households and businesses alike, and the housing market is no exception.

How Uncertainty Is Impacting Home Sales

Uncertainty isn’t always easy to define. It’s more of a feeling than a number. Still, economists have developed ways to measure it, like the Economic Policy Uncertainty Index. In February 2025, this index soared to a record high - over twice its previous pandemic-era peak. At the same time, Canadian businesses reported plummeting confidence, and workers in export-reliant industries began worrying about job security.

This rising anxiety had a tangible impact: people began holding off on major decisions. That included buying homes.

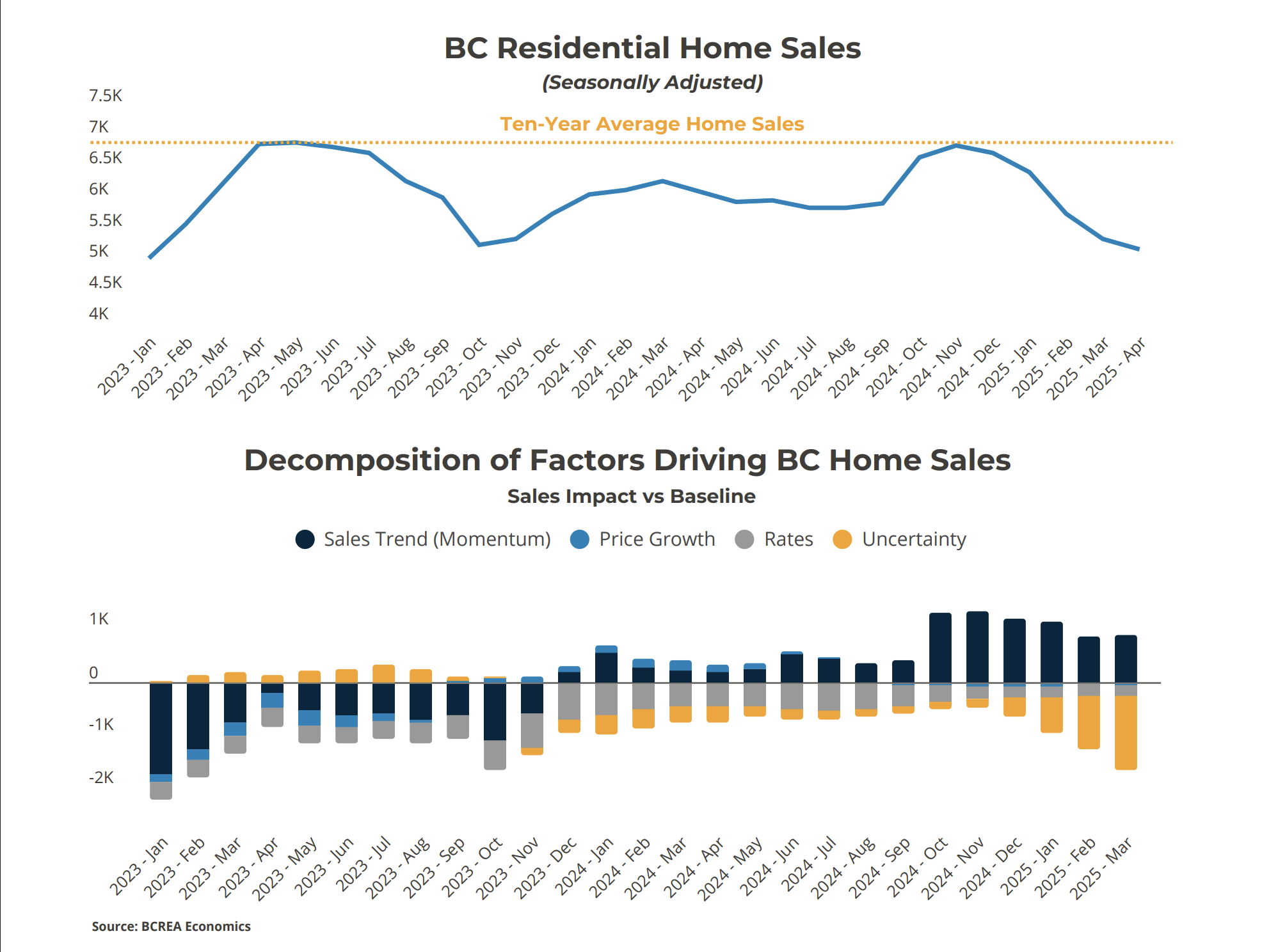

BC home sales, which had been gaining strength late in 2024, took a sharp turn in February and continued to fall through March and April. By spring, sales were sitting 25% below their 10-year average.

The Numbers Behind the Narrative

To better understand what’s driving this downturn, we enhanced a standard housing market model with the Economic Policy Uncertainty Index. The results were telling: while lower interest rates had supported sales, the spike in uncertainty is estimated to have caused roughly 3,000 fewer home sales in the first quarter of 2025 alone.

The good news? Uncertainty doesn’t last forever. And there are signs it may already be starting to ease.

What Could Come Next?

Following Canada’s federal election, the tone of trade talks with the US has become less confrontational. That’s encouraging, but it doesn’t guarantee smooth sailing. Tariffs could still be expanded, and the economic fallout could be significant—even if BC is somewhat insulated compared to other provinces.

The Bank of Canada recently released two potential scenarios for the economy, depending on how trade tensions play out. In the worst-case scenario, a year-long recession and rising inflation are on the table.

So what happens to the housing market under each outcome?

If trade tensions ease and uncertainty drops significantly, there’s plenty of pent-up demand ready to fuel a sharp recovery in home sales.

If new tariffs are introduced, the recovery will depend heavily on the Bank of Canada’s response.

So far, the Bank has signaled that monetary policy can’t fix trade issues, but some economists argue that if tariffs drag on growth, the Bank should respond by lowering interest rates anyway. If that happens, we could see mortgage rates fall below 3.5%, giving the housing market a much-needed boost.

Looking Ahead

The BC housing market is at a crossroads. On one hand, a resolution to trade tensions could bring a quick and powerful rebound. On the other, if uncertainty gives way to a tougher economic reality, recovery could be slower and more reliant on interest rate cuts.

As we move through the rest of 2025, the hope is that clarity will return—and with it, the confidence households need to move forward with important life decisions, like buying a home.

Until then, all eyes are on the negotiations, the economy, and how policymakers respond.

Click here to read the full BCREA Economics Market Intelligence Report

source: BCREA

Comments:

Post Your Comment: