Summary of Findings:

A tariff on all Canadian imports to the United States would have serious consequences for the Canadian and BC economies.

A 25% tariff would push both the Canadian and BC economies into recession. The impact could be compounded by a broader trade war and retaliatory tariffs by Canada.

Under the most likely scenario, the BC housing market would see a temporary decline in activity before posting a robust recovery as mortgage rates decline substantially, thereby unleashing pent-up demand.

Until quite recently, the Canadian economic outlook appeared clear; Canada was braced for a stronger 2025, driven by higher consumption and business investment on the back of lower interest rates. However, that outlook has become uncertain following the threats of tariffs from the newly installed American administration. Potential Canadian retaliation to the broad-based American tariffs could have serious implications for the Canadian economy and housing market.

This Market Intelligence report seeks to unpack the uncertainty surrounding potential tariffs by exploring several potential tariff scenarios and their implications for the BC housing market.

Scenario One: Tariffs With Limited or No Retaliation from Canada

A one-way tariff imposed by America on Canadian imports would lower total demand for our goods would reduce overall economic growth. This would lead to significant job losses and temper investment due to increased uncertainty for Canadian businesses.

Scenario Two: Tariffs With Retaliation

Under a two-way tariff scenario, both the Canadian and US economies would result in lower output, employment, investment, and trade.

Impact of US Tariffs on BC Housing

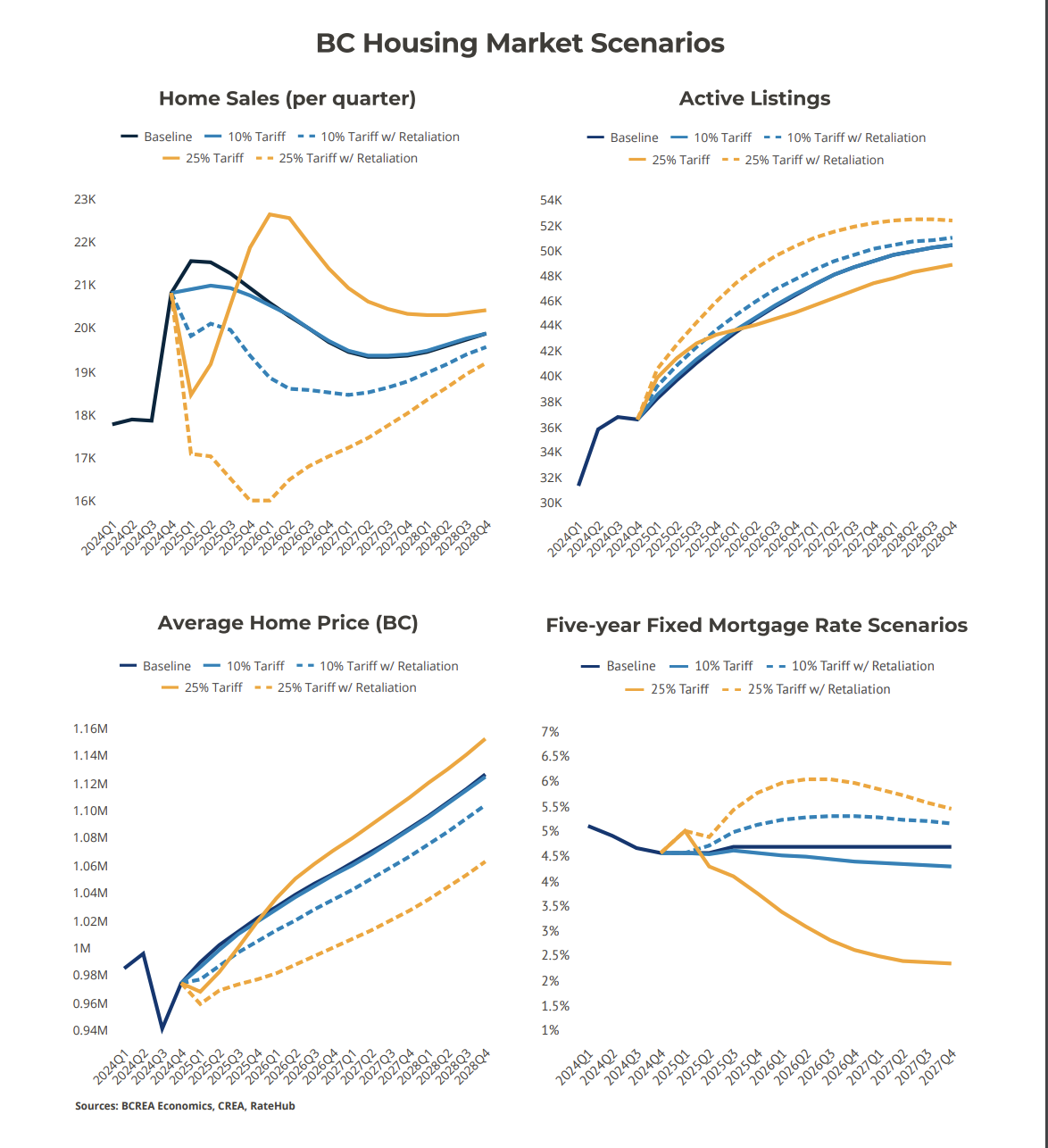

Depending on whether and how broadly Canada retaliates with its own tariffs, inflation could be higher or lower than the current forecast with divergent policy responses from the Bank of Canada and a diverse set of outcomes for sales activity and prices.

Tariffs will have a negative impact on economic growth in BC and at a 25% level could push the economy into recession. Previous recessions have shown that the usual pattern for the BC housing market is an immediate decline in housing activity and then a robust recovery as the central bank lowers rates to stimulate the economy (1). However, the effect on inflation caused by a potential Canadian retaliation and the Bank's ability to lower rates could disrupt the normal pattern.

Illustrated in the graph above are a diverse set of potential mortgage rates contingent on inflation and growth outcomes. Mortgage rates could be as high as 6.25% under a full-retaliation scenario or as low as 2.5% under no retaliation.

Assuming the US tariffs are imposed, the most likely scenario involves a limited and targeted set of tariffs on US imports. This would result in limited impact on inflation while also allowing the Bank of Canada to respond to any massive shifts to the economy. While a 10% tariff would have minor negative impacts for the housing market, a 25% tariff with no or limited retaliation, would generate a temporary decline in activity followed by a strong market activity as plunging mortgage rates releases pent-up demand.

Read the Full Market Intelligence Report

(1) British Columbia Real Estate Association. (2023, January 19). A guide to recessions and the BC housing market. British Columbia Real Estate Association.

Comments:

Post Your Comment: