News: Vancouver Real Estate Market

Posted on

April 3, 2013

by

David Reimers

Lower levels of both supply and demand in recent months are holding home prices in check in the Greater Vancouver housing market.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales in Greater Vancouver reached 2,347 on the Multiple Listing Service® (MLS®) in March 2013. This represents an 18.3 per cent decrease compared to the 2,874 sales recorded in March 2012, and a 30.6 per cent increase compared to the 1,797...

Posted on

March 22, 2013

by

David Reimers

Overall Impression of the Area: Ranch Park is undergoing a transformation. A prime area for infill development. Ranch Park is an established area well known for it's larger lot sizes and spectacular views. Property values tend to be lower than average for the Coquitlam area. As older long-time residents start down sizing into smaller homes, their properties are being acquired by young families. Builders are also seeing the potential and building monster million dollar mansions.

Report Prepared...

Posted on

March 19, 2013

by

David Reimers

Canadian manufacturing sales began the year on a down note, declining 0.2 per cent in January, the fourth decline in the last five months. However, weakness was not broad based with just 7 of 21 manufacturing sectors posting declining sales. Adjusting for inflation, Canadian manufacturing sales were 0.4 per cent lower.

Sales in the BC manufacturing sector rose 2.1 per cent in January, and were 1.4 per cent higher year-over-year. BC manufacturing growth continues to be lead by a...

Posted on

March 4, 2013

by

David Reimers

Home sale activity has trended below historical averages for a full year in the Greater Vancouver housing market.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales in Greater Vancouver reached 1,797 on the Multiple Listing Service® (MLS®) in February 2013. This represents a 29.4 per cent decrease compared to the 2,545 sales recorded in February 2012, and a 33 per cent increase compared to the 1,351 sales in January 2012.

Last month's...

Posted on

February 11, 2013

by

David Reimers

Home buyer demand remains below historical averages in the Greater Vancouver housing market. This has led some home sellers to remove their homes from the market in recent months.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales in Greater Vancouver reached 1,351 on the Multiple Listing Service® (MLS®) in January 2013. This represents a 14.3 per cent decrease compared to the 1,577 sales recorded in January 2012, and an 18.3 per...

Posted on

January 30, 2013

by

David Reimers

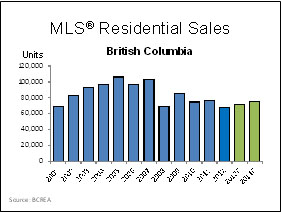

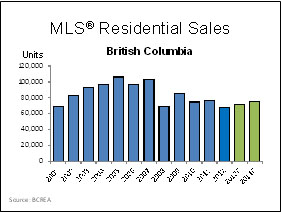

The British Columbia Real Estate Association (BCREA) released its 2013 First Quarter Housing Forecast Update today. BC Multiple Listing Service® (MLS®) residential sales are forecast to increase 5.6 per cent to 71,450 units this year, before increasing a further 6.1 per cent to 75,830 units in 2014. The five-year average is 74,600 unit sales, while the ten-year average is 86,800 unit sales. A record 106,300 MLS® residential sales were recorded in 2005. The British Columbia Real Estate Association (BCREA) released its 2013 First Quarter Housing Forecast Update today. BC Multiple Listing Service® (MLS®) residential sales are forecast to increase 5.6 per cent to 71,450 units this year, before increasing a further 6.1 per cent to 75,830 units in 2014. The five-year average is 74,600 unit sales, while the ten-year average is 86,800 unit sales. A record 106,300 MLS® residential sales were recorded in 2005.

"2013 is shaping up to be...

Posted on

January 30, 2013

by

David Reimers

The US economy unexpectedly contracted by 0.1 per cent in the fourth quarter of 2012 as growth was pulled down by the largest decline in defense spending in four decades. The US economy expanded 2.2 per cent for all of 2012.

While the modest decline in GDP is likely to spur use of the "R" word (recession) in the media, it is worth noting that today's release is the advanced estimate for real GDP and is subject to revisions which can be substantial. Moreover the contraction in output was almost...

Posted on

January 25, 2013

by

David Reimers

Join the Greater Vancouver Real Estate community and start sharing everything related to the market.

Posted on

January 23, 2013

by

David Reimers

Our 2013 residential market study was prepared to help you make informed real estate decisions. It’s designed to help you identify trends in your market place and to show how residential real estate in your area has performed over the last ten years. Order your free copy here > Real Estate Market Study

Posted on

January 8, 2013

by

David Reimers

Canadian House Prices Edge Up in Third Quarter While the Number of Home Sales Fall

First-time buyer activity drops as market adjusts to new mortgage regulations

TORONTO, January 8, 2013 The Royal LePage House Price Survey and Market Survey Forecast released today showed the average price of a home in Canada increased year-over-year between 2.0 and 4.0 per cent in the fourth quarter of 2012. Compared to 2012, fewer homes are expected to trade hands in the first half of 2013, which should slow the pace...

Posted on

January 4, 2013

by

David Reimers

On the heels of a surge in employment in November, Canadian employment posted a strong increase again in December, growing by 40,000 jobs. December's increase in jobs was entirely due to gains in full-time employment. The Canadian economy added just shy of 100,000 new jobs in the final two months of 2012, which pushed the national unemployment rate to 7.1 per cent, its lowest level in 4 years.

Job growth in the BC economy was essentially flat as an increase of 4,300 in full-time...

Posted on

January 3, 2013

by

David Reimers

The Greater Vancouver housing market experienced below average home sale totals, typical home listing activity and modest declines in home prices in 2012.

The Real Estate Board of Greater Vancouver (REBGV) reports that total sales of detached, attached and apartment properties in 2012 reached 25,032, a 22.7 per cent decline from the 32,387 sales recorded in 2011, and an 18.2 per cent decrease from the 30,595 residential sales in 2010. Last year’s home sale total was 25.7...

Posted on

December 13, 2012

by

David Reimers

.jpg) Vancouver, BC – December 13, 2012. The British Columbia Real Estate Association (BCREA) reports that the dollar volume of homes sold through the Multiple Listing Service® (MLS®) in BC declined 24.6 per cent to $2.3 billion in November compared to the same month last year. A total of 4,680 MLS® residential unit sales were recorded over the same period, down 17 per cent from November 2011. The average MLS® residential price was $480,861, down 9.1 per cent from a year ago. Vancouver, BC – December 13, 2012. The British Columbia Real Estate Association (BCREA) reports that the dollar volume of homes sold through the Multiple Listing Service® (MLS®) in BC declined 24.6 per cent to $2.3 billion in November compared to the same month last year. A total of 4,680 MLS® residential unit sales were recorded over the same period, down 17 per cent from November 2011. The average MLS® residential price was $480,861, down 9.1 per cent from a year ago.

...

Posted on

December 11, 2012

by

David Reimers

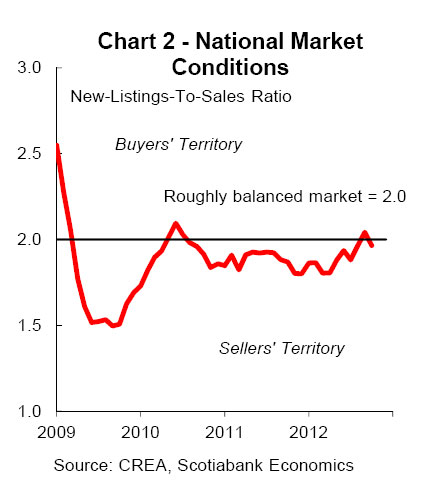

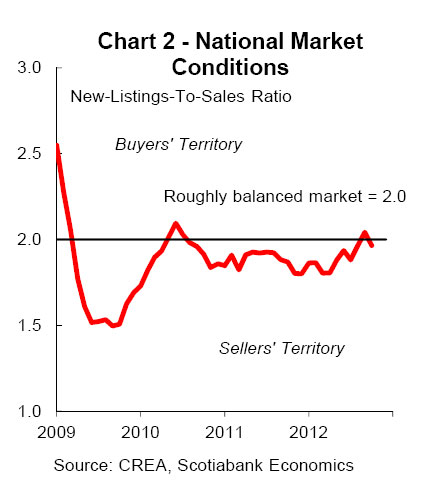

Canada’s national housing market is shifting toward a more sustainable path, though significant differences in regional conditions continue. Canada’s national housing market is shifting toward a more sustainable path, though significant differences in regional conditions continue.

Canada’s housing market so far appears to have achieved a soft landing, with cooler but fairly steady sales and pricing through the fall. Nationally, sales in October were down about 10% from strong spring levels, but are only marginally below the average pace of the past decade. Early reports for November point to more of the same.

...

Posted on

December 4, 2012

by

David Reimers

.jpg) I am now convinced that we will never hear the end of housing bubble speak. The premise is now as firmly entrenched in popular consciousness as carbon emissions and TMZ. It has taken the form of idolatry in the blogosphere, where any countervailing narrative is demonized. It has catapulted university dropouts into media darlings because of a hackneyed webpage and an opinion. It has been tarted up by so-called experts who predict impending doom year after year, despite being completely wrong every... I am now convinced that we will never hear the end of housing bubble speak. The premise is now as firmly entrenched in popular consciousness as carbon emissions and TMZ. It has taken the form of idolatry in the blogosphere, where any countervailing narrative is demonized. It has catapulted university dropouts into media darlings because of a hackneyed webpage and an opinion. It has been tarted up by so-called experts who predict impending doom year after year, despite being completely wrong every...

Posted on

December 4, 2012

by

David Reimers

Over the past six months, the Greater Vancouver housing market has seen a reduction in the number of homes listed for sale, a gradual moderation in home prices and a decrease in property sales compared to historical averages.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales of detached, attached and apartment properties reached 1,686 on the region’s Multiple Listing Service® (MLS®) in November, a 28.6 per cent decline compared...

Posted on

December 4, 2012

by

David Reimers

.jpg) Following the surprise announcement that Mark Carney will be departing to helm the Bank of England, it was back to business as usual at the Bank of Canada as interest rates were once again held constant at 1 per cent. The statement released this morning in support of the interest rate decision noted that while the global economy appears to have stabilized, it still remains vulnerable to major shocks from the US or Europe. The Canadian economy is growing at a slightly softer pace than... Following the surprise announcement that Mark Carney will be departing to helm the Bank of England, it was back to business as usual at the Bank of Canada as interest rates were once again held constant at 1 per cent. The statement released this morning in support of the interest rate decision noted that while the global economy appears to have stabilized, it still remains vulnerable to major shocks from the US or Europe. The Canadian economy is growing at a slightly softer pace than...

Posted on

December 3, 2012

by

David Reimers

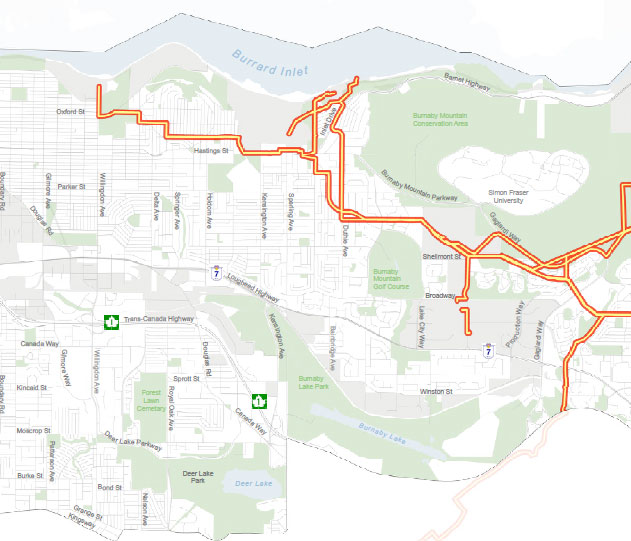

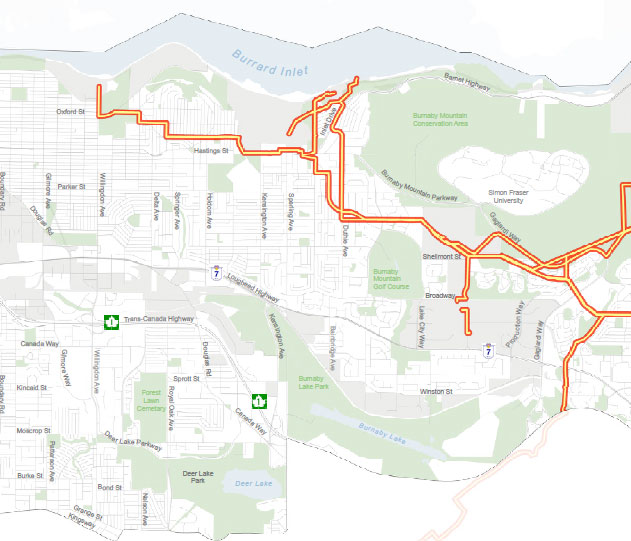

Among its many provisions, it makes significant changes to legislation including the Canadian Environmental Assessment Act, the National Energy Board Act, and the Species at Risk Act. Among its many provisions, it makes significant changes to legislation including the Canadian Environmental Assessment Act, the National Energy Board Act, and the Species at Risk Act.

These changes affect the operation of the National Energy Board (NEB), which has potentially serious implications for property owners along pipelines.

This includes the 2,200 property owners along the Trans Mountain Pipeline, owned by Kinder Morgan, which runs from the Alberta tar sands and...

Posted on

November 29, 2012

by

David Reimers

TORONTO - One of the country's big banking groups has issued a report saying that a cooling in Canadian house prices may not be all bad news.

The CIBC World Markets says the slowing of Canadian home sales will "take a bite" out of economic growth but adds there could be "winners as well as losers across the economy."

For more information click here.

Posted on

November 14, 2012

by

David Reimers

MISSISSAUGA, Ont. - The latest real estate outlook from ReMax says Canadian home sales increased or held steady in much of the country this year despite tighter financing and economic uncertainty abroad.

ReMax says the trend is expected to continue, with home-buying activity propped-up by low interest rates and an improved economic picture in 2013.

The report found that the number of homes sold is expected to match or exceed 2011 levels, led by strong activity in Calgary and other western...

Posted on

November 2, 2012

by

David Reimers

.jpg) The Greater Vancouver housing market saw a slight increase in the number of home sales, a slight reduction in the number of listings, and a slight decrease in home prices in October compared to the summer months. With those changes, the sales-to-active-listings ratio increased to 11 per cent in October from 8 per cent in September. The Greater Vancouver housing market saw a slight increase in the number of home sales, a slight reduction in the number of listings, and a slight decrease in home prices in October compared to the summer months. With those changes, the sales-to-active-listings ratio increased to 11 per cent in October from 8 per cent in September.

The Real Estate Board of Greater Vancouver (REBGV) reported 1,931 residential property sales of detached, attached and apartment properties on the region’s...

Posted on

October 31, 2012

by

David Reimers

About a third of Baby Boomers plan to sell their home to fund their retirement, according to a study that questions whether buyers will dry up as that massive segment of the population downsizes.

Bank of Montreal is warning Boomers not to count on that nest egg, while other observers suggest that even if prices don’t plunge, big increases in property values are a thing of the past.

“They shouldn’t be relying on their homes because there are risks,” says Marlena...

Posted on

October 30, 2012

by

David Reimers

While many concerns stem from the Canadian housing market, it will not see an American-style crash, a new Canadian Imperial Bank of Commerce report says.

House prices will likely fall north of the border in the next year or two, but a number of factors are likely to mitigate the impact on borrowers and the broader economy here, it suggests. It forecasts that the Canadian market will likely go through a soft landing, which is exactly what policy makers in Ottawa are hoping.

Factors that...

Posted on

October 26, 2012

by

David Reimers

BCREA 2012 Fourth Quarter Housing Forecast BCREA 2012 Fourth Quarter Housing Forecast

Vancouver, BC – October 26, 2012. The British Columbia Real Estate Association (BCREA) released its 2012 Fourth Quarter Housing Forecast today.

BC Multiple Listing Service® (MLS®) residential sales are forecast to decline 9.8 per cent to 69,200 units this year, before increasing 8.3 per cent to 74,920 units in 2013. The fifteen-year average is 79,000 unit sales, while a record 106,300 MLS® residential sales were...

Posted on

October 24, 2012

by

David Reimers

Posted on

October 22, 2012

by

David Reimers

A laneway house (also known as a coach house or carriage house) is a detached dwelling located typically in the area where the garage would be on a single-family lot. It faces the lane, while maintaining the backyard open space. Alternatively on a corner lot it would face the side street. At least one parking space is needed for each laneway home. Most laneway houses include a garage. A laneway house (also known as a coach house or carriage house) is a detached dwelling located typically in the area where the garage would be on a single-family lot. It faces the lane, while maintaining the backyard open space. Alternatively on a corner lot it would face the side street. At least one parking space is needed for each laneway home. Most laneway houses include a garage.

Laneway houses present an excellent opportunity for homeowners to increase the value of their existing homes by adding...

Posted on

October 16, 2012

by

David Reimers

What is a depreciation report?

A depreciation report is a legislated planning requirement for strata corporations in British Columbia. Depreciation reports are used to establish long term planning for common property and common assets to determine:

1) What assets you own ( an inventory )

2) The asset condition ( evaluation )

3) When things need to be replaced ( the anticipated maintenance, repair and replacement )

4) How much money you currently have ( contingency reserve report )

5) What...

Posted on

October 15, 2012

by

David Reimers

Vancouver, BC - October 15, 2012. The British Columbia Real Estate Association (BCREA) reports that the dollar volume of homes sold through the Multiple Listing Service® (MLS®) in BC declined 28.5 per cent to $2.2 billion in September compared to the same month last year. A total of 4,539 MLS® residential unit sales were recorded over the same period, down 24.3 per cent from September 2011. The average MLS® residential price was $494,213, down 5.6 per cent from a year... Vancouver, BC - October 15, 2012. The British Columbia Real Estate Association (BCREA) reports that the dollar volume of homes sold through the Multiple Listing Service® (MLS®) in BC declined 28.5 per cent to $2.2 billion in September compared to the same month last year. A total of 4,539 MLS® residential unit sales were recorded over the same period, down 24.3 per cent from September 2011. The average MLS® residential price was $494,213, down 5.6 per cent from a year...

Posted on

October 9, 2012

by

David Reimers

Number of units being built year-to-date more than 10 per cent higher than 2011

Construction is going strong in Metro Vancouver, even though home resale prices are dropping slightly and sales activity is significantly below historical levels.

Metro Vancouver housing starts in were on pace in September to reach 20,000 units by year’s end, mostly driven by multi-family developments, Canada Mortgage and Housing Corporation reported Tuesday.

There were 293 single-detached housing starts...

Posted on

October 3, 2012

by

David Reimers

Canadian House Prices Edge Up in Third Quarter While the Number of Home Sales Fall

First-time buyer activity drops as market adjusts to new mortgage regulations

TORONTO, October 3, 2012 – The Royal LePage House Price Survey released today showed the average price of a home in Canada increased year-over-year between 1.8 and 4.8 per cent in the third quarter of 2012.

Survey findings indicated that the average standard two-storey home in Canada increased 4 per cent year-over-year rising...

Posted on

October 2, 2012

by

David Reimers

Vancouver’s real estate board says there have probably been “some reductions” in prices in some of its hottest markets, acknowledging the country’s most expensive city to buy a home in is now a buyer’s market.

The Real Estate Board of Greater Vancouver maintains that prices remain stable overall in its market. It says its benchmark price index is $606,100, a 0.8% drop from a year ago and a 2.3% decline over the last three months.

But there is no mistaking...

Posted on

October 2, 2012

by

David Reimers

The summer of 2012 drew to a close in September with home sale activity well below historical averages in the Greater Vancouver housing market.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales of detached, attached and apartment properties reached 1,516 in September, a 32.5 per cent decline compared to the 2,246 sales in September 2011 and an 8.1 per cent decline compared to the 1,649 sales in August 2012.

September sales were 41.6 per cent below the 10-year...

Posted on

September 27, 2012

by

David Reimers

The slumping real estate market is illustrative of the effect it has on the economy as homeowners feel a negative 'wealth effect'

The slump in British Columbia's real estate market serves as a cautionary note for other provinces that are bracing for bumps in economic growth.

When homes slip in price, consumers rein in spending, producing a ripple effect on local merchants and slowing down the broader economy.

Jacques Marcil, senior economist at Toronto-Dominion Bank, points to...

Posted on

September 19, 2012

by

David Reimers

Posted on

September 10, 2012

by

David Reimers

Sagging home sales and flat prices have prompted speculation that the “housing bubble” might be

about to burst — a prospect that immediately catches the attention of British Columbians.

But there is no housing bubble, according to Tsur Somerville, director of the University of B.C.’s Centre

for Urban Economics in the Sauder School of Business.

“You can’t burst a bubble that wasn’t there,” said Somerville. “But you can have prices...

Posted on

September 7, 2012

by

David Reimers

Canadian job growth bounced back in August as employment expanded by 34,300. Just as last month's over 30,000 job losses were entirely due to part-time employment, this month's gains were the result of those jobs being added back. Part-time employment grew by 46,700 while, full-time employment fell 12,500. The Canadian unemployment rate held steady at 7.3 per cent

BC employment followed the national trend, adding 14,900 new jobs in August. However, job growth was entirely based...

Posted on

September 5, 2012

by

David Reimers

Metro Vancouver realtors saw their second-slowest August for residential property sales since 1998,

but prices are relatively stable, the region’s main real estate board reported Wednesday.

“We’ve seen a slowdown in the market in terms of the number of transactions, but there’s relative price

stability,” Real Estate Board of Greater Vancouver president Eugen Klein said.

Detached housing prices were relatively flat in August compared with a year ago, while...

Posted on

September 5, 2012

by

David Reimers

Home sale activity remained below long-term averages in the Greater Vancouver housing market in August. Home sale activity remained below long-term averages in the Greater Vancouver housing market in August.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales of detached, attached and apartment properties reached 1,649 in August, a 30.7 per cent decline compared to the 2,378 sales in August 2011 and a 21.4 per cent decline compared to the 2,098 sales in July 2012.

August sales were the second lowest total for the month in the region since 1998 and 39.2 per cent...

Posted on

August 30, 2012

by

David Reimers

The average price of homes sold in B.C. is forecast to fall 7.8 per cent this year, but that doesn’t mean

the price of a typical home will drop, the B.C. Real Estate Association’s chief economist Cameron Muir

said Thursday.

The average Multiple Listings Service price is down and will continue to fall because fewer single-family

homes in tony neighbourhoods are selling, while more less-expensive homes are selling, Muir said,

adding that there has been a noticeable lull in demand...

Posted on

August 30, 2012

by

David Reimers

The average price of homes sold in B.C. is forecast to fall 7.8 per cent this year, but that doesn’t mean

the price of a typical home will drop, the B.C. Real Estate Association’s chief economist Cameron Muir

said Thursday.

The average Multiple Listings Service price is down and will continue to fall because fewer single-family

homes in tony neighbourhoods are selling, while more less-expensive homes are selling, Muir said,

adding that there has been a noticeable lull in demand...

Posted on

August 28, 2012

by

David Reimers

For the complete news release, including detailed statistics, click: here.

Vancouver, BC – August 28, 2012. The BCREA Commercial Leading Indicator (CLI) continued to trend higher in the second quarter of 2012, rising 0.8 points to 112.6 from a revised level of 111.8 in the first quarter. On a year-over-year basis, the CLI is now 3.7 per cent above its level in the second quarter of 2011.

" The trend in the CLI continues to signal strong growth in the BC commercial... The trend in the CLI continues to signal strong growth in the BC commercial...

Posted on

August 21, 2012

by

David Reimers

RBC Royal Bank raised two of its mortgage rates by one-fifth of a point each on Tuesday, and it’s likely

other lenders will soon follow suit, an economist told The Sun.

Helmut Pastrick, chief economist at Central 1 Credit Union, said bond yields have gone up by about 0.3

per cent in the past four weeks, and that is probably driving the increase.

“Sentiment has improved with respect to Europe and the economic outlook,” Pastrick said. “The

economic news was quite...

Posted on

August 9, 2012

by

David Reimers

Buying a first home is one of life’s most significant purchases, and a new poll shows many first-time homebuyers wish they had done things differently.

More than half of those who were asked said they would make a bigger down payment and that they would buy a home sooner, the 2012 TD Canada Trust First Time Home Buyers Report found.

“The survey results reveal that people generally want the best of both worlds, to be able to buy a home sooner and to have a bigger down payment,...

Posted on

August 8, 2012

by

David Reimers

Metro Vancouver home prices may slip a bit over the next year, but don’t expect them to drop sharply, according to a

report released Wednesday by Central 1 Credit Union.

The report was released on the same day as a Scotiabank report with a more pessimistic outlook for prices, saying the

downside risks to Canada’s housing market are increasing with a correction concentrated in Toronto and Vancouver, and

that prices should fall 10 per cent over the next two or three years.

...

Posted on

August 2, 2012

by

David Reimers

Residential property sales in Greater Vancouver remained at a 10-year low in July, while the number of properties being listed for sale continued to edge down and prices remained relatively stable.

The Real Estate Board of Greater Vancouver (REBGV) reports that there were 2,098 residential property sales of detached, attached and apartment properties in July. That’s an 18.4 per cent decline compared to the 2,571 sales in July 2011 and an 11.2 per cent decline compared to...

Posted on

July 31, 2012

by

David Reimers

Property in the Lower Mainland continues to attract investors world-wide. It is therefore important for you (the non-resident) to understand Canada’s tax laws to help avoid mistakes and pitfalls. Here is a brief summary of information, relevant to you the foreign investor:

Resident or non-resident?

Under Canada’s income tax system, whether an individual is a resident or a non-resident can play a role in how much tax you will pay.

- As a resident you must pay Canadian...

Posted on

July 28, 2012

by

David Reimers

Metro Vancouver apartment building sales are on par with last year, although values have soared in the central city,

according to a recently released report.

“They [buyers] are buying tired buildings that haven’t been kept up and then spending a lot of money on renovating

them,” said apartment broker David Goodman, co-owner of HQ Commercial Real Estate Services and author of the

Goodman Report, a Metro Vancouver apartment building market review.

The report concluded...

Posted on

July 10, 2012

by

David Reimers

Canada's Housing Market at a Tipping Point

National price appreciation forecast to soften modestly for the remainder of the year

TORONTO, July 10, 2012 – The Royal LePage House Price Survey and Market Survey Forecast released today showed the average price of a home in Canada increased year-over-year between 3.3 and 5.5 per cent in the second quarter of 2012. By the end of 2012, Royal LePage expects national average prices to be 3.2 per cent higher compared to the same period of 2011, in line...

Posted on

July 9, 2012

by

David Reimers

Posted on

July 4, 2012

by

David Reimers

The number of residential property sales hit a 10-year low in Greater Vancouver for June, while prices remained relatively stable.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential property sales of detached, attached and apartment properties reached 2,362 in June, a 27.6 per cent decline compared to the 3,262 sales in June 2011 and a 17.2 per cent decline compared to the 2,853 sales in May 2012.

June sales were the lowest total for the month in...

|

The British Columbia Real Estate Association (BCREA) released its 2013 First Quarter Housing Forecast Update today. BC Multiple Listing Service® (MLS®) residential sales are forecast to increase 5.6 per cent to 71,450 units this year, before increasing a further 6.1 per cent to 75,830 units in 2014. The five-year average is 74,600 unit sales, while the ten-year average is 86,800 unit sales. A record 106,300 MLS® residential sales were recorded in 2005.

The British Columbia Real Estate Association (BCREA) released its 2013 First Quarter Housing Forecast Update today. BC Multiple Listing Service® (MLS®) residential sales are forecast to increase 5.6 per cent to 71,450 units this year, before increasing a further 6.1 per cent to 75,830 units in 2014. The five-year average is 74,600 unit sales, while the ten-year average is 86,800 unit sales. A record 106,300 MLS® residential sales were recorded in 2005..jpg) Vancouver, BC – December 13, 2012. The British Columbia Real Estate Association (BCREA) reports that the dollar volume of homes sold through the Multiple Listing Service® (MLS®) in BC declined 24.6 per cent to $2.3 billion in November compared to the same month last year. A total of 4,680 MLS® residential unit sales were recorded over the same period, down 17 per cent from November 2011. The average MLS® residential price was $480,861, down 9.1 per cent from a year ago.

Vancouver, BC – December 13, 2012. The British Columbia Real Estate Association (BCREA) reports that the dollar volume of homes sold through the Multiple Listing Service® (MLS®) in BC declined 24.6 per cent to $2.3 billion in November compared to the same month last year. A total of 4,680 MLS® residential unit sales were recorded over the same period, down 17 per cent from November 2011. The average MLS® residential price was $480,861, down 9.1 per cent from a year ago. Canada’s national housing market is shifting toward a more sustainable path, though significant differences in regional conditions continue.

Canada’s national housing market is shifting toward a more sustainable path, though significant differences in regional conditions continue..jpg) I am now convinced that we will never hear the end of housing bubble speak. The premise is now as firmly entrenched in popular consciousness as carbon emissions and TMZ. It has taken the form of idolatry in the blogosphere, where any countervailing narrative is demonized. It has catapulted university dropouts into media darlings because of a hackneyed webpage and an opinion. It has been tarted up by so-called experts who predict impending doom year after year, despite being completely wrong every...

I am now convinced that we will never hear the end of housing bubble speak. The premise is now as firmly entrenched in popular consciousness as carbon emissions and TMZ. It has taken the form of idolatry in the blogosphere, where any countervailing narrative is demonized. It has catapulted university dropouts into media darlings because of a hackneyed webpage and an opinion. It has been tarted up by so-called experts who predict impending doom year after year, despite being completely wrong every... Among its many provisions, it makes significant changes to legislation including the Canadian Environmental Assessment Act, the National Energy Board Act, and the Species at Risk Act.

Among its many provisions, it makes significant changes to legislation including the Canadian Environmental Assessment Act, the National Energy Board Act, and the Species at Risk Act..jpg) The Greater Vancouver housing market saw a slight increase in the number of home sales, a slight reduction in the number of listings, and a slight decrease in home prices in October compared to the summer months. With those changes, the sales-to-active-listings ratio increased to 11 per cent in October from 8 per cent in September.

The Greater Vancouver housing market saw a slight increase in the number of home sales, a slight reduction in the number of listings, and a slight decrease in home prices in October compared to the summer months. With those changes, the sales-to-active-listings ratio increased to 11 per cent in October from 8 per cent in September.

BCREA 2012 Fourth Quarter Housing Forecast

BCREA 2012 Fourth Quarter Housing Forecast A laneway house (also known as a coach house or carriage house) is a detached dwelling located typically in the area where the garage would be on a single-family lot. It faces the lane, while maintaining the backyard open space. Alternatively on a corner lot it would face the side street. At least one parking space is needed for each laneway home. Most laneway houses include a garage.

A laneway house (also known as a coach house or carriage house) is a detached dwelling located typically in the area where the garage would be on a single-family lot. It faces the lane, while maintaining the backyard open space. Alternatively on a corner lot it would face the side street. At least one parking space is needed for each laneway home. Most laneway houses include a garage. Vancouver, BC - October 15, 2012. The British Columbia Real Estate Association (BCREA) reports that the dollar volume of homes sold through the Multiple Listing Service® (MLS®) in BC declined 28.5 per cent to $2.2 billion in September compared to the same month last year. A total of 4,539 MLS® residential unit sales were recorded over the same period, down 24.3 per cent from September 2011. The average MLS® residential price was $494,213, down 5.6 per cent from a year...

Vancouver, BC - October 15, 2012. The British Columbia Real Estate Association (BCREA) reports that the dollar volume of homes sold through the Multiple Listing Service® (MLS®) in BC declined 28.5 per cent to $2.2 billion in September compared to the same month last year. A total of 4,539 MLS® residential unit sales were recorded over the same period, down 24.3 per cent from September 2011. The average MLS® residential price was $494,213, down 5.6 per cent from a year... Home sale activity remained below long-term averages in the Greater Vancouver housing market in August.

Home sale activity remained below long-term averages in the Greater Vancouver housing market in August. The trend in the CLI continues to signal strong growth in the BC commercial...

The trend in the CLI continues to signal strong growth in the BC commercial...