News: Vancouver Real Estate Market

Posted on

February 11, 2026

by

David Reimers

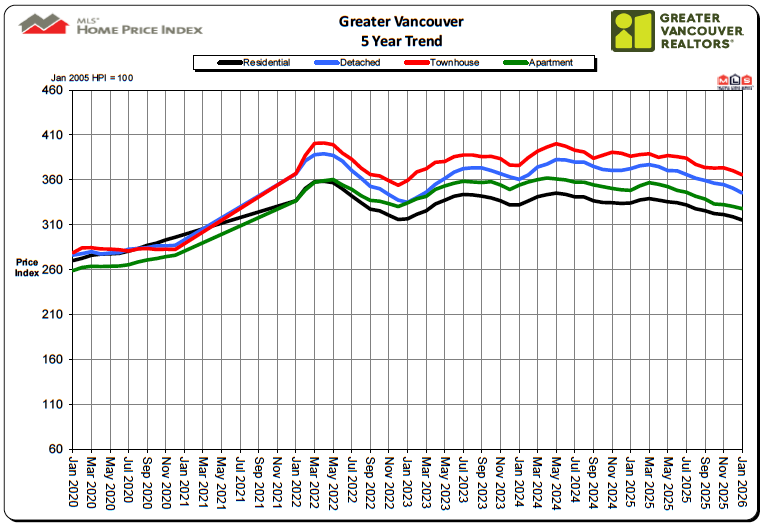

Last year’s market trends continued in January as home sales registered on the MLS® in Metro Vancouver* were 28.5% lower than last year, setting the year off to a quieter start. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 1,107 in January 2026, a 28.7% decrease from the 1,552 sales recorded in January 2025. This was 30.9% below the 10-year seasonal average (1,602). "On their own, the January sales appear alarming, but it’s important to put these figures...

Posted on

January 15, 2026

by

David Reimers

Key highlights from the fourth quarter: In the fourth quarter of 2025, the national aggregate home price decreased 1.5% year over year. The Greater Montreal Area’s aggregate home price increased 4.5% year over year, while the greater Toronto and Vancouver markets recorded declines of 5.7% and 4.1%, respectively, in the fourth quarter. Quebec City recorded the highest year-over-year aggregate price increase (13.2%) among Canada’s major regions for the seventh consecutive quarter. Royal LePage® expects...

Posted on

January 14, 2026

by

David Reimers

Home sales registered in the Multiple Listing Service® (MLS®) in Metro Vancouver* finished the year down 10%, marking the lowest annual sales total in over twenty years. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 23,800 in 2025, a 10.4% decrease from the 26,561 sales recorded in 2024, and a 9.3% decrease from the 26,249 sales in 2023. Last year’s sales total was 24.7% below the 10-year annual sales average (31,625). "This year was one for the history books....

Posted on

December 3, 2025

by

David Reimers

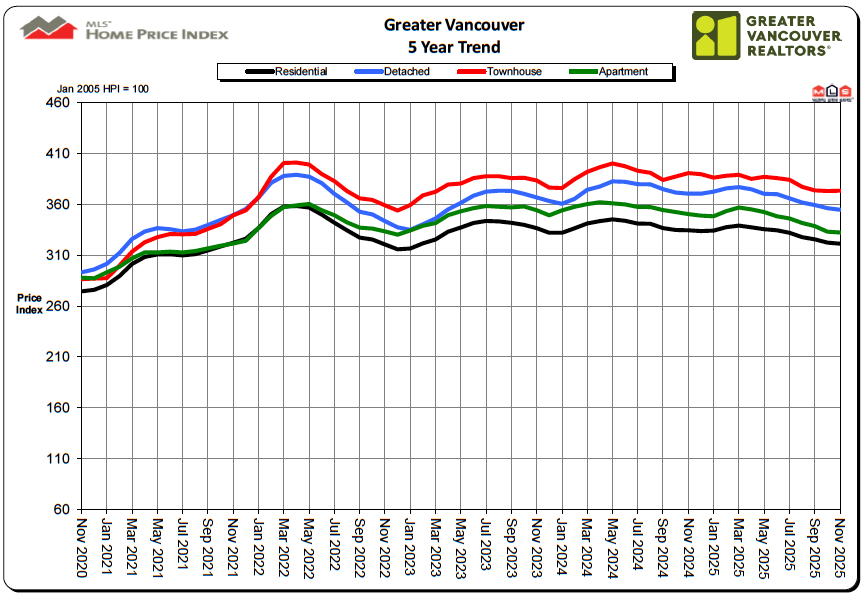

Metro Vancouver* home-sale trends observed in October continued in November, as sales registered on the MLS® remained lower than this time last year. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 1,846 in November 2025, a 15.4% decrease from the 2,181 sales recorded in November 2024. This was 20.6% below the 10-year seasonal average (2,324). "As the year draws to a close, the data continues telling a story of a market with many buyers patiently...

Posted on

November 19, 2025

by

David Reimers

Key highlights from the third quarter: In the third quarter of 2025, the national aggregate home price remained flat year over year; declined 1.2% over Q2. The Greater Montreal Area’s aggregate home price increased 4.9% year over year, while the greater Toronto and Vancouver markets recorded declines of 3.5% and 3.1%, respectively, in the third quarter. National year-end forecast adjusted downward due to price declines in greater regions of Toronto and Vancouver, with the aggregate price...

Posted on

November 7, 2025

by

David Reimers

Home sales registered on the MLS® in Metro Vancouver* were 14% lower than last October, as the trend of slower sales and building inventory creates favourable conditions for those looking to buy in the fall market. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 2,255 in October 2025, a 14.3% decrease from the 2,632 sales recorded in October 2024. This was 14.5% below the 10-year seasonal average (2,638). "October is typically the last month of the year...

Posted on

October 15, 2025

by

David Reimers

Home sales in the first half of the year were much slower than our H1 forecast had anticipated. While it's difficult to pin the blame entirely on the economic uncertainty arising from the tariff-related policies of the new US administration, it's also difficult to say these developments have had no effect either. And despite home prices having eased since the start of the year, in addition to three Bank of Canada interest rate cuts, buyers have remained hesitant to re-enter the market. Our H2 forecast...

Posted on

October 9, 2025

by

David Reimers

Amid rising political unrest in the U.S. and persistent tensions between the two countries, more Canadians are choosing to ‘stay local’ and limit trips across the border. In addition, many who own U.S. residential properties are reconsidering their long-term strategies—with some already making the decision to sell. According to a recent Royal LePage survey, conducted by Burson, more than half (54%) of Canadians who currently own residential property in the U.S. say they are planning to sell within...

Posted on

September 4, 2025

by

David Reimers

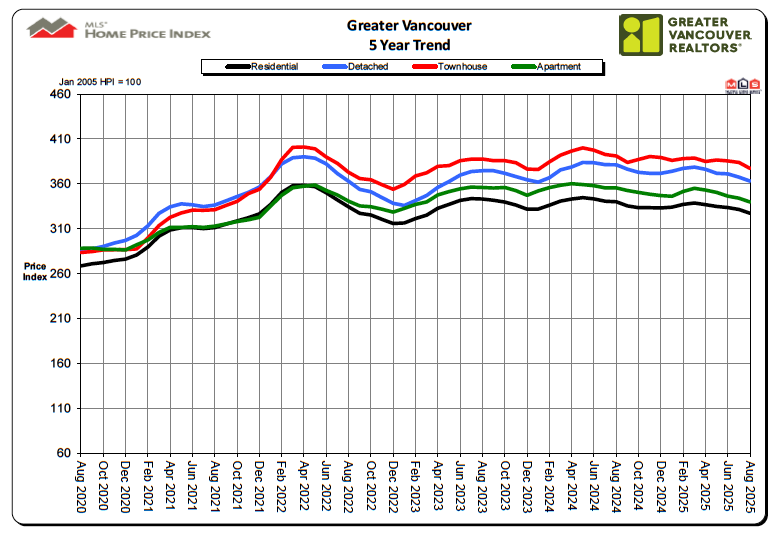

Easing prices brought more Metro Vancouver homebuyers off the sidelines in August, with home sales on the MLS® up nearly 3% from August last year. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 1,959 in August 2025, a 2.9% increase from the 1,904 sales recorded in August 2024. This was 19.2% below the 10-year seasonal average (2,424). “The August sales figures add further confirmation that sales activity across Metro Vancouver appears to...

Posted on

August 6, 2025

by

David Reimers

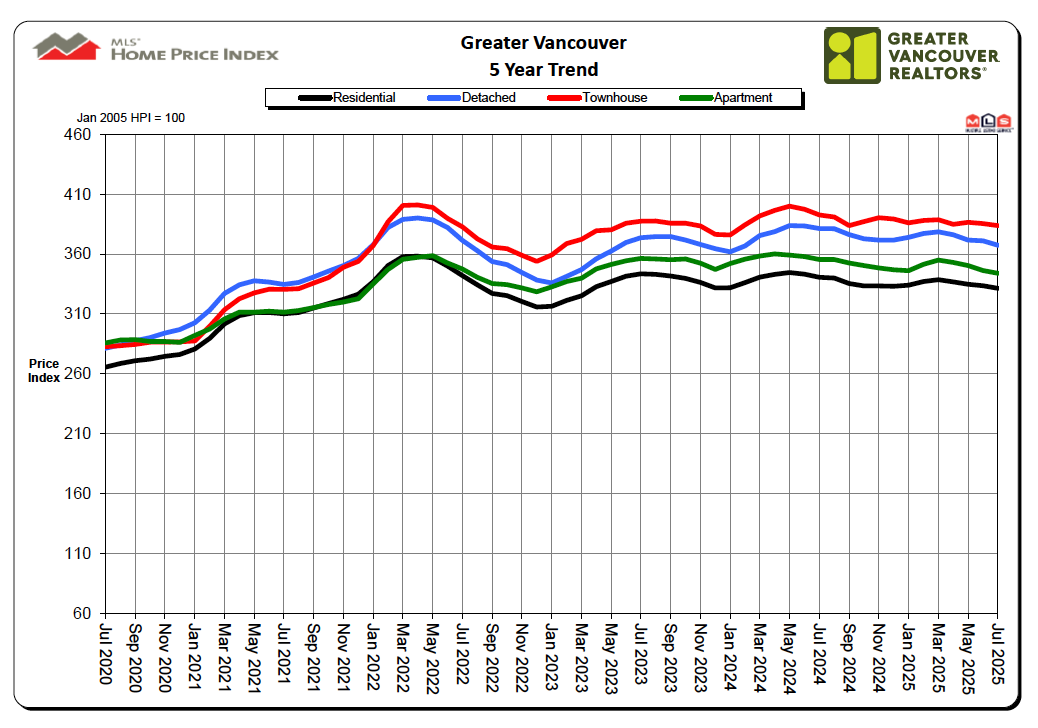

VANCOUVER - August 5, 2025 - Home sales registered on the MLS® across Metro Vancouver in July extended the early signs of recovery that emerged in June, now down just two per cent from July of last year. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 2,286 in July 2025, a 2% decrease from the 2,333 sales recorded in July 2024. This was 13.9% below the 10-year seasonal average (2,656). “The June data showed early signs of sales activity...

Posted on

July 24, 2025

by

David Reimers

Why work with a specialist REALTOR® in Metro Vancouver If you are buying, selling, or developing land in Metro Vancouver, especially under the new small-scale multi-unit housing (SSMUH) policies, partnering with a REALTOR® who understands the process inside and out is critical. Here are 8 reasons why working with a specialist in this space can help you reduce risk, increase profit, and stay ahead of the curve. 1. Up-to-date knowledge of changing policies Municipal rules and zoning regulations are shifting...

Posted on

July 17, 2025

by

David Reimers

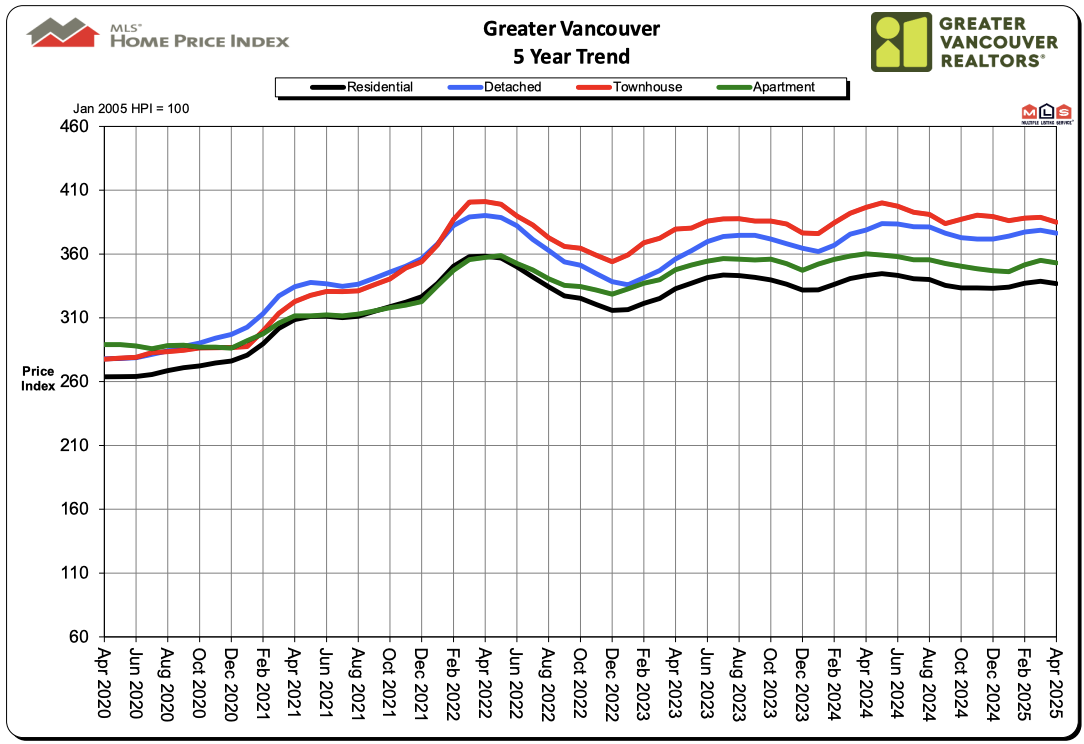

Key highlights from the second quarter: The national aggregate home price flatlined, rising a modest 0.3% year over year in Q2 2025, and declining 0.4% over Q1. Greater Montreal Area’s aggregate home price increased 3.5% year over year, while the greater Toronto and Vancouver markets recorded declines of 3.0% and 2.6%, respectively in the second quarter. 38 of the 64 cities in the report saw year-over-year prices rise or remain roughly flat, while 26 markets saw home prices decline – a majority...

Posted on

July 8, 2025

by

David Reimers

VANCOUVER, BC – July 3, 2025 – Following a turbulent first half of the year, MLS®-registered home sales across Metro Vancouver are beginning to show signs of recovery—down 10% year-over-year, a notable improvement from last month’s 20% decline. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 2,181 in June 2025, a 9.8% decrease from the 2,418 sales recorded in June 2024. This was 25.8% below the 10-year seasonal average (2,940). "On a trended basis, signs are...

Posted on

June 5, 2025

by

David Reimers

The Metro Vancouver housing market continued its slow pace in May 2025, as rising inventory levels failed to translate into increased sales activity. According to the latest data from the Greater Vancouver REALTORS® (GVR), home sales were notably subdued while available listings surged to a ten-year high. Sales Slump Despite Seasonal TrendsA total of 2,228 residential properties were sold in Metro Vancouver in May, marking an 18.5% drop compared to the 2,733 sales recorded in May 2024. Even more striking,...

Posted on

May 15, 2025

by

David Reimers

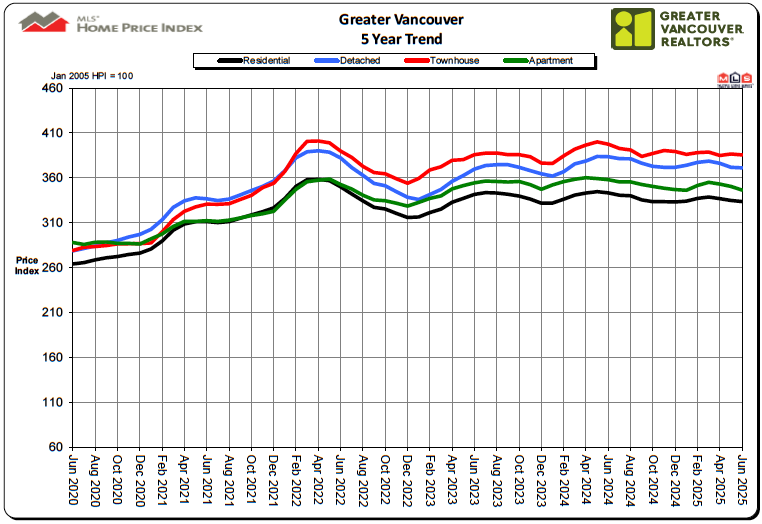

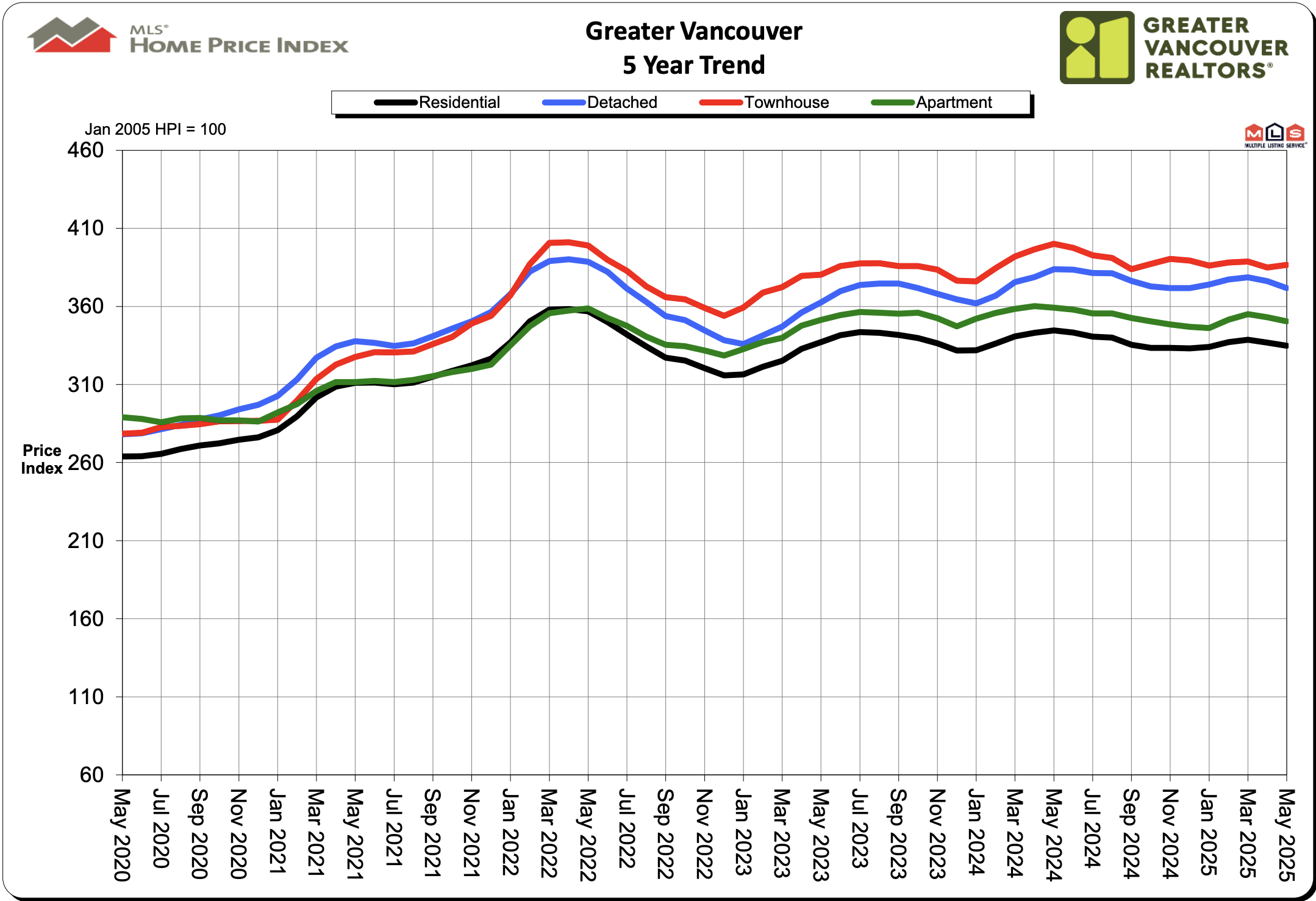

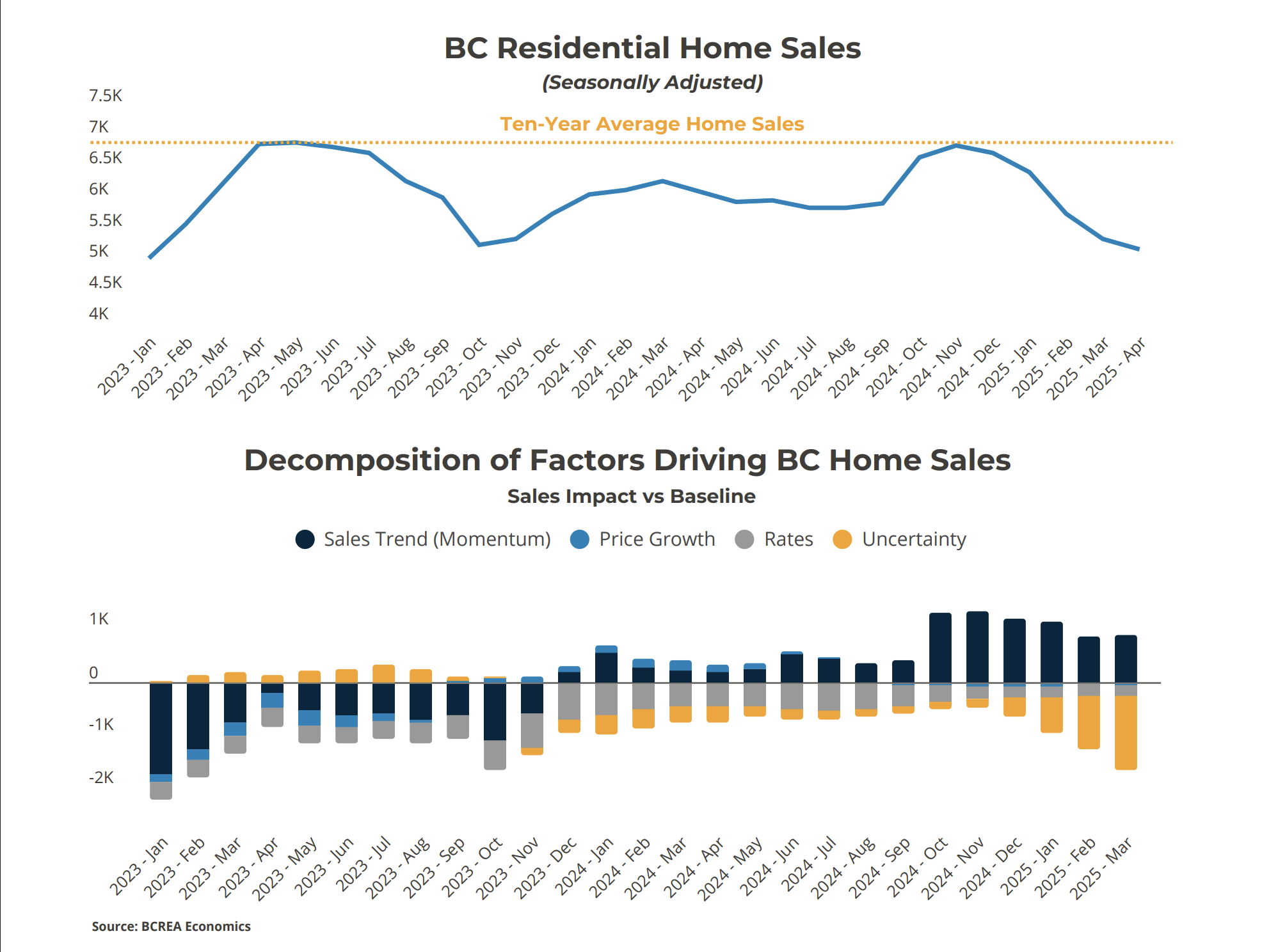

The BC housing market entered 2025 with a sense of optimism. After a slow couple of years, sales were finally rebounding, thanks to falling interest rates and pent-up demand. But just as momentum began to build, a new challenge emerged: uncertainty. Specifically, the uncertainty surrounding the United States’ unpredictable tariff policy under President Donald Trump has weighed heavily on households and businesses alike, and the housing market is no exception. How Uncertainty Is Impacting Home Sales...

Posted on

May 6, 2025

by

David Reimers

VANCOUVER, BC – May 2, 2025 – The cooler trend in Metro Vancouver’s housing market continued through April, as home sales remained well below typical seasonal levels. Despite improved borrowing conditions, many buyers are still taking a wait-and-see approach. According to the Greater Vancouver REALTORS® (GVR), residential home sales totalled 2,163 in April 2025, marking a 23.6% decline from the 2,831 sales recorded in April 2024. Sales also fell 28.2% below the 10-year seasonal average of 3,014. “From...

Posted on

April 2, 2025

by

David Reimers

Home sales in Metro Vancouver fell to their lowest March levels since 2019, while the number of active listings continued to rise. According to the Greater Vancouver REALTORS® (GVR), 2,091 residential properties were sold in March 2025, marking a 13.4% decline from March 2024’s 2,415 sales. This figure was also 36.8% below the 10-year seasonal average of 3,308. “If we put aside uncertainty surrounding the new U.S. administration, buyers in Metro Vancouver haven’t seen such favourable conditions in years,”...

Posted on

March 5, 2025

by

David Reimers

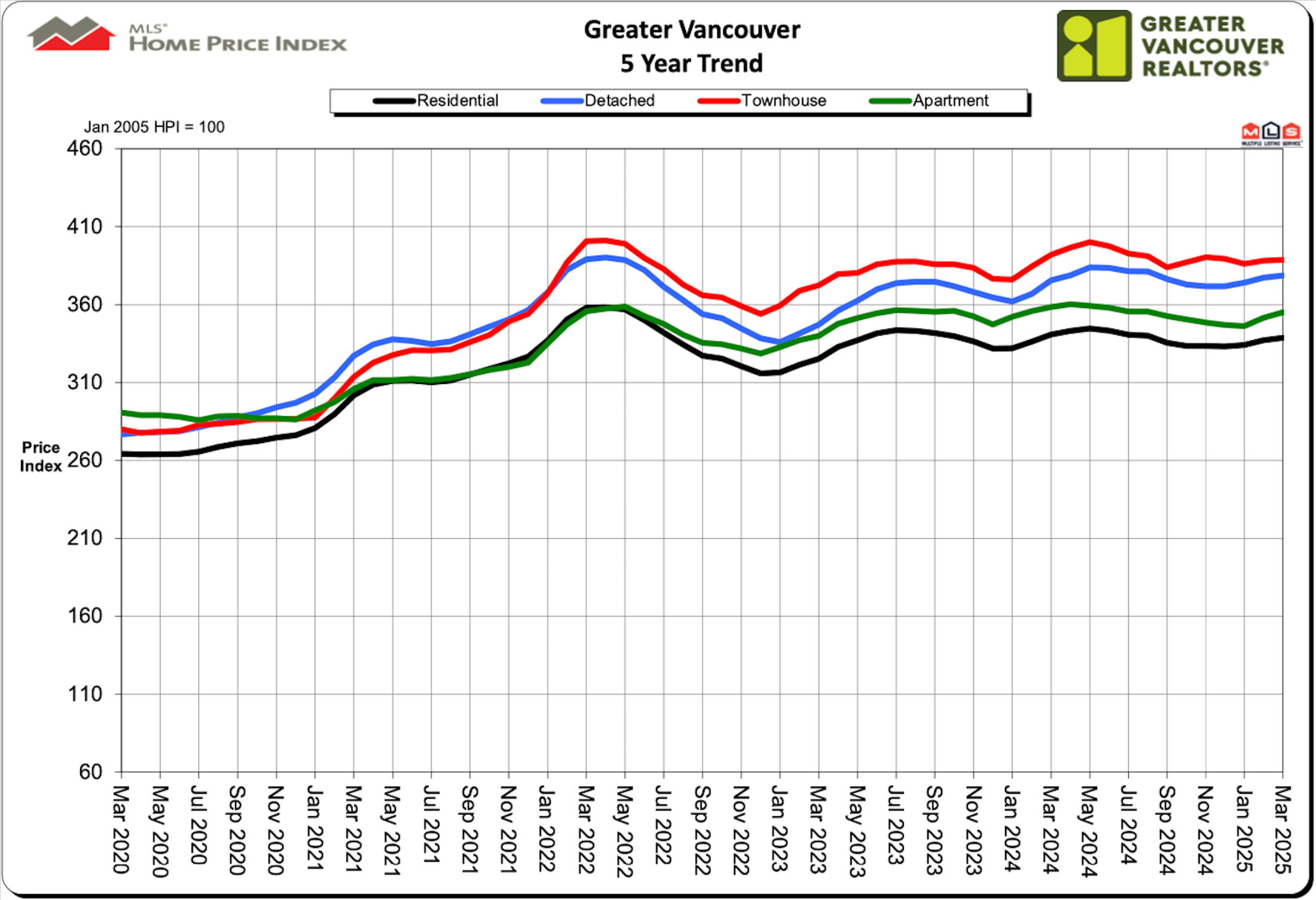

The number of newly listed properties on the MLS® in Metro Vancouver rose more moderately in February, after a 46% year-over-year increase of new listings in January, helping keep market conditions in balanced territory.

The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 1,827 on Metro Vancouver’s Multiple Listing Service® (MLS®) in February 2025, an 11.7% decrease from the 2,070 sales recorded in February 2024. This total was 28.9% below the 10-year seasonal...

Posted on

February 4, 2025

by

David Reimers

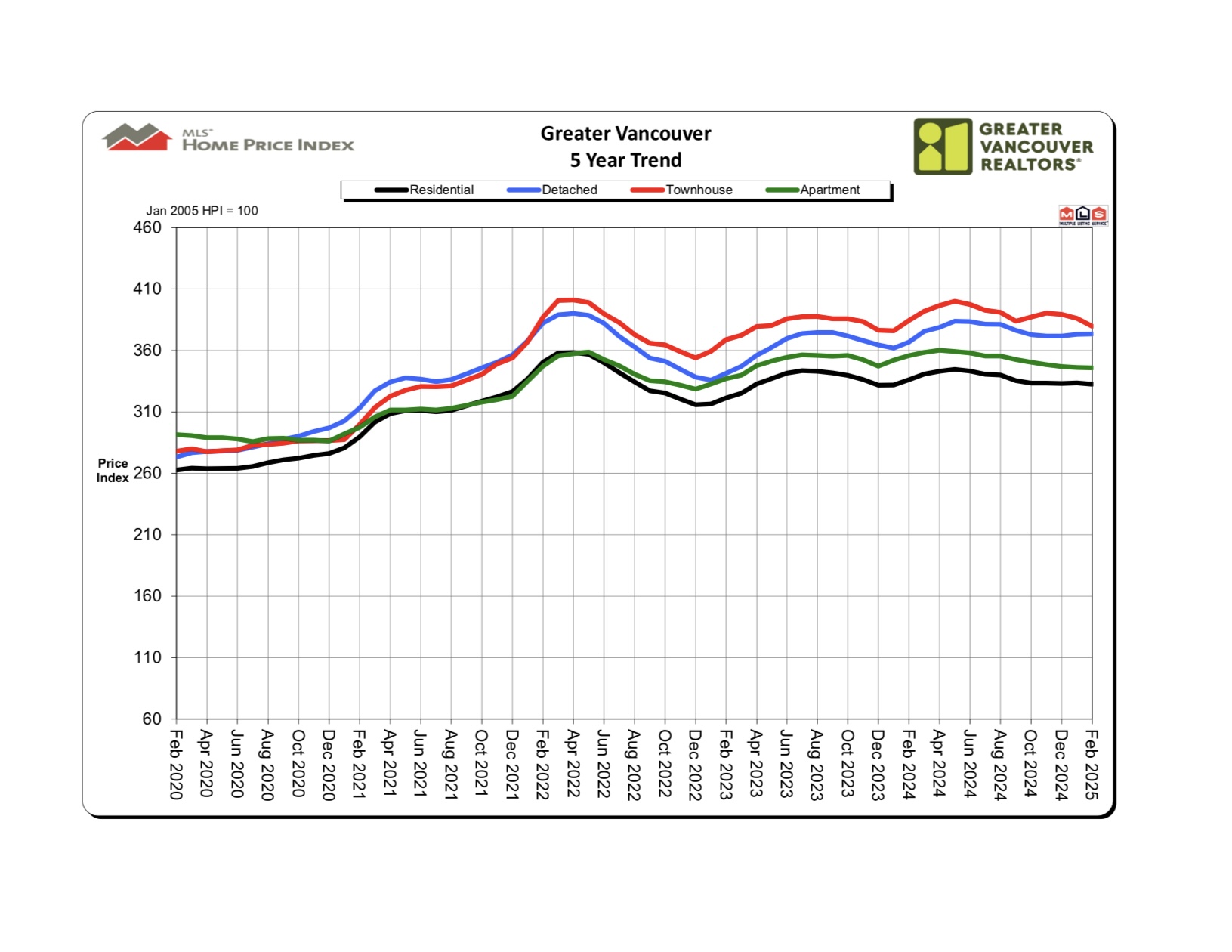

Photo source: Unsplash. Photographer: Lucy Claire Newly listed Metro Vancouver homes on the MLS® rose 46% year-over-year in January. Sellers appear to be eager to enter the market to start the year.

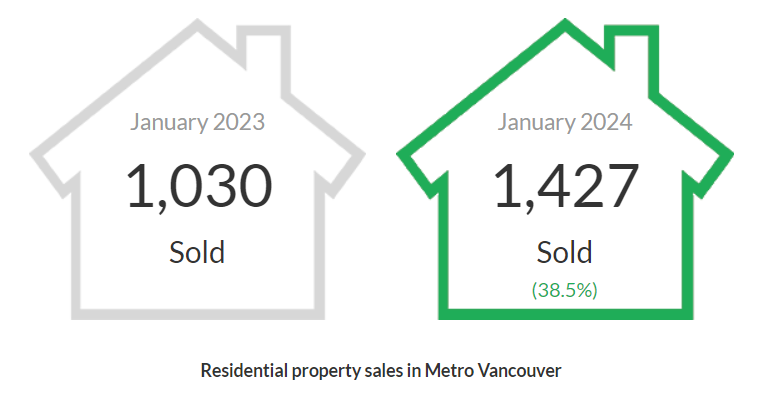

The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 1,552 in January 2025, an 8.8% increase from the 1,427 sales recorded in January 2024, which was 11.3% below the 10-year seasonal average of 1,749.

Andrew Lis, GVR’s director of economics and data analytics,...

Posted on

January 16, 2025

by

David Reimers

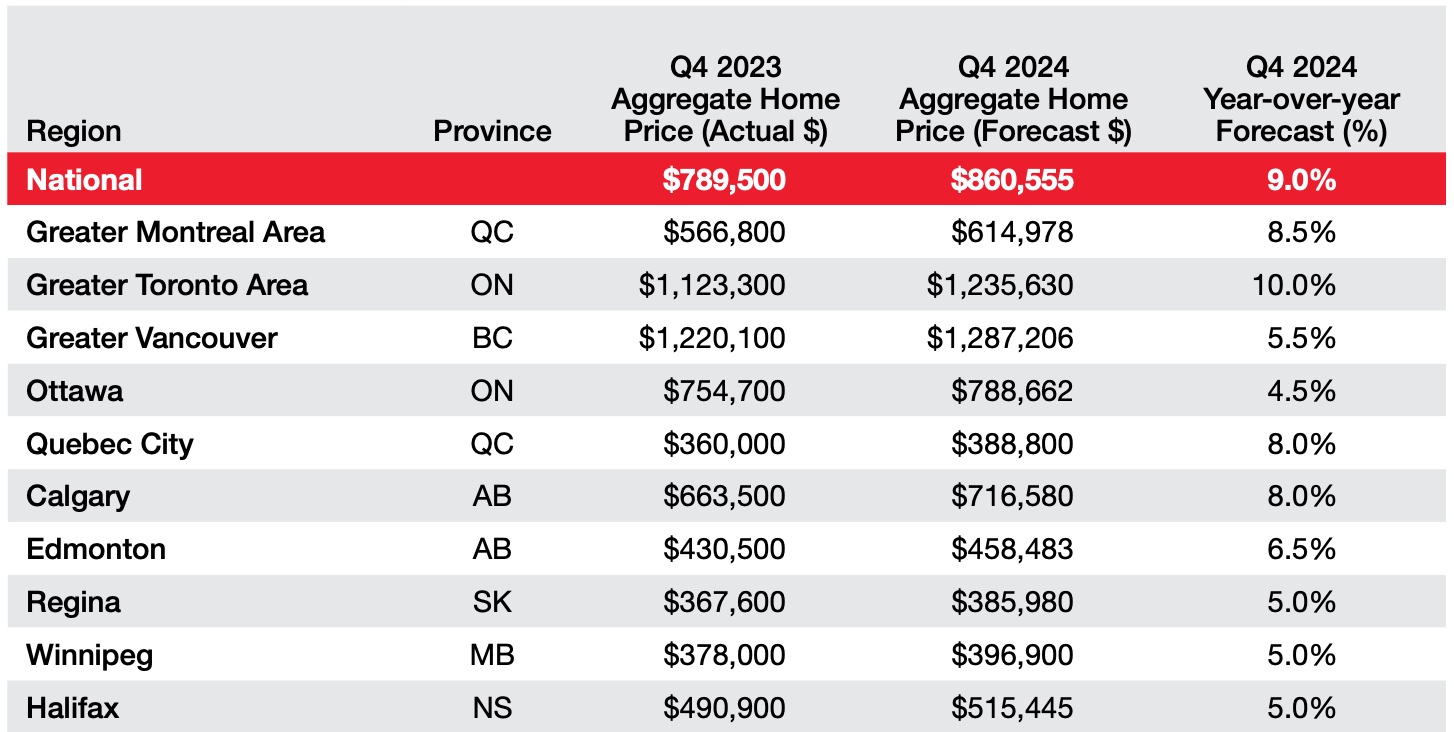

Activity picked up pace in the final quarter of 2024, leading to moderate price increases and paving the way for a brisk spring market. Highlights: Royal LePage forecasts that the aggregate price of Canadian homes will increase 6.0 percent in the fourth quarter of 2025, compared to 2024’s Q4. Housing policy and affordability are expected to be primary ballot box issues shaping voters’ decisions in the federal election. Greater Montreal Area’s aggregate home price increased 8.2 percent year-over-year,...

Posted on

January 6, 2025

by

David Reimers

Posted in

december sales, Greater Vancouver, greater vancouver house prices, greater vancouver housing market, Greater Vancouver Market Forecast, Greater Vancouver Market Updates, Greater Vancouver Real Estate Market, Greater Vancouver real estate market update, greater vancouver realtors, Home Evaluation, home sales, market report, Metro Vancouver Real Estate

Home sales registered on the Multiple Listing Service® (MLS®) in Metro Vancouver increased over 30 % in December, compared to the previous year, signaling strengthening demand-side momentum to close-out the year. The Greater Vancouver REALTORS® (GVR) reports that regional residential sales totaled 26,561 in 2024, a 1.2 % rise from 26,249 sales in 2023, and a 9.2 % decrease from the 29,261 sales in 2022. The total of last year’s sales was 20.9 % below the 10-year annual sales average of 33,559....

Posted on

December 13, 2024

by

David Reimers

The predicted decline of interest rates along with new lending rules will bring buyers back to the market next year. Highlights: Royal LePage forecasts that the aggregate price of Canadian homes will increase by 6.0 percent year-over-year in the fourth quarter of 2025. Nationally, single-family detached and condominiums are expected to increase 7.0 percent and 3.5 percent, respectively, year over year in Q4 of 2025. The Greater Montreal Area aggregate home price appreciation (6.5 percent) is expected...

Posted on

December 3, 2024

by

David Reimers

Home sales registered in the MLS® in Metro Vancouver increased 28% year-over-year in November, building on the momentum of the 30 % year-over-year rise seen in October. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totaled 2,181 in November 2024, a 28.1% increase from the 1,702 sales recorded in the same month last year. This was 12.8% below the 10-year seasonal average (2,500). “When we saw demand pick up in October, there was still a question over...

Posted on

November 4, 2024

by

David Reimers

After months of tracking approximately 20% below the ten-year seasonal average, Metro Vancouver home sales surged more than 30% year-over-year in October. The Greater Vancouver REALTORS® (GVR) reports that residential sales registered on the Multiple Listing Service® (MLS®) in the region totalled 2,632 in October 2024, a 31.9% increase from the 1,996 sales recorded in October 2023. This was 5.5% below the 10-year seasonal average (2,784). “Typically, reductions to mortgage rates boost demand,...

Posted on

October 3, 2024

by

David Reimers

Home sales registered on the MLS® in Metro Vancouver declined 3.8% year over year in September, suggesting recent reductions in borrowing costs are having a limited effect in spurring demand so far. Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 1,852 in September 2024, a 3.8% decrease from the 1,926 sales recorded in September 2023. This was 26% below the 10-year seasonal average (2,502). “Real estate watchers have been monitoring the data for signs of renewed...

Posted on

September 4, 2024

by

David Reimers

Home sales registered on the MLS® in Metro Vancouver remained below their 10 year seasonal averages in August as summer holidays come to a close. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 1,904 in August 2024, a 17.1% decrease from the 2,296 sales recorded in August 2023. This total was also 26% below the 10-year seasonal average (2,572). “From a seasonal perspective, August is typically a slower month for sales than June or July. In...

Posted on

August 27, 2024

by

David Reimers

A recent survey reveals that 83% of adults in British Columbia, specifically those from Generation Z and younger Millennials aged 18 to 38 (born between 1986 and 2006), view homeownership as a valuable investment. Among those who don't currently own a home, 77% plan to purchase a primary residence during their lifetime. "Young Canadians have a strong positive outlook on owning real estate. Despite the challenges of entering urban markets like Vancouver, this demographic sees homeownership as a significant...

Posted on

August 2, 2024

by

David Reimers

Posted in

2024 Market Report, Greater Vancouver, greater vancouver house prices, greater vancouver housing market, Greater Vancouver Market Forecast, Greater Vancouver Market Updates, greater vancouver real estate, Greater Vancouver Real Estate Market, Greater Vancouver real estate market update, greater vancouver realtors, Home Evaluation

Newly listed properties registered on the Multiple Listing Service® (MLS®) rose nearly 20% year over year in July, helping to maintain a healthy level of inventory in the Metro Vancouver housing market. On the demand side, the Greater Vancouver REALTORS®2 (GVR) reports that residential sales in the region totalled 2,333 in July 2024, a 5% decrease from the 2,455 sales recorded in July 2023. This was 17.6% below the 10-year seasonal average (2,831). “The trend of buyers remaining hesitant, that...

Posted on

July 4, 2024

by

David Reimers

Metro Vancouver home sales registered on the MLS® remained below seasonal and historical averages in June. With reduced competition among buyers, inventory has continued to accumulate to levels not seen since the spring of 2019. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totaled 2,418 in June 2024, a decrease of 19.1% from the 2,988 sales recorded in June 2023. This was 23.6% below the 10-year seasonal average (3,166). “The June data continued a trend we’ve been...

Posted on

June 20, 2024

by

David Reimers

As a real estate agent serving the Greater Vancouver area, I often hear from clients about the challenges and dreams of owning a home. A recent report from Royal LePage sheds light on an encouraging trend: despite affordability challenges, a quarter of Canadian renters plan to purchase a home within the next two years. This report provides valuable insights into the current mindset of renters and what it means for the real estate market. Rising Ambitions Amidst Rising Costs The report highlights that...

Posted on

June 13, 2024

by

David Reimers

The number of transactions on the Multiple Listing Service® (MLS®) saw a decline in May compared to the usual for this period in Metro Vancouver, contributing to the ongoing accumulation of homes available for sale, with over 13,000 homes now actively listed on the MLS® in the region. The Greater Vancouver REALTORS® (GVR) reported that residential sales in the region totaled 2,733 in May 2024, marking a 19.9% decrease from the 3,411 sales recorded in May 2023. Last month’s sales were also down 19.6%...

Posted on

May 2, 2024

by

David Reimers

Active home listings on the MLS® in Metro Vancouver continued to rise in April, showing a 42% year-over-year increase, surpassing the 12,000 mark—a level last observed in the region during the summer of 2020. Greater Vancouver REALTORS® (GVR) report that residential sales in the area totaled 2,831 in April 2024, marking a 3.3% increase from the 2,741 sales recorded in April 2023. However, this figure was 12.2% below the 10-year seasonal average of 3,223. “It’s a feat to see inventory finally climb above...

Posted on

April 13, 2024

by

David Reimers

Typically, spring marks the peak activity season for Canada's real estate sector, as warmer weather prompts a surge in buying and selling nationwide. However, in 2024, this bustling spring market began earlier than usual and is experiencing added pressure. Aspiring homebuyers, who had been waiting on the sidelines, are now reentering the market ahead of anticipated interest rate cuts. This rush is expected to intensify competition and drive home prices even higher. Royal LePage® projects that the overall...

Posted on

April 8, 2024

by

David Reimers

The amount of Metro Vancouver homes listed for sale on the MLS® rose nearly 23% year-over-year, providing more opportunity for buyers looking for a home this spring. The Greater Vancouver REALTORS® (GVR) reports that residential sales in the area totalled 2,415 in March 2024, a 4.7% decrease from the 2,535 sales recorded in March 2023. This was 31.2% below the 10-year seasonal average (3,512). “If you’re finding the weather a little chillier than last spring, you may find some comfort in knowing that...

Posted on

March 14, 2024

by

David Reimers

Purchasing your first home is a significant milestone, but it often comes with a multitude of financial considerations. In British Columbia, one consideration is the Property Transfer Tax (PTT), which can add a significant cost to your home purchase. However, there's good news for first-time homebuyers in BC: the First-Time Home Buyer Property Transfer Tax Exemption. As a future home owner, it is important to know the exemption details and how it can benefit you as a first-time homebuyer. Understanding...

Posted on

March 12, 2024

by

David Reimers

In the ever-shifting landscape of real estate regulations, British Columbia is implementing a transformative measure: the BC Home Flipping Tax. Set to take effect on January 1, 2025, this tax targets income derived from the sale of properties owned for less than two years. As we go through how this tax works, it is important to note this tax is on top of our already established (January 1, 2023) Federal Flipping Tax. This rule ensures that profits from flipped properties are treated as business income,...

Posted on

March 4, 2024

by

David Reimers

In January, Metro Vancouver home sellers appeared mostly hesitant, however new listings rose 31% year-over-year in February, bringing a significant number of newly listed properties to the market. Greater Vancouver REALTORS® (GVR) reports that the residential sales in the region totalled 2,070 in February 2024, a 13.5% increase from the 1,824 sales recorded in February 2023. This was 23.3 per cent below the 10-year seasonal average (2,699). “While the pace of home sales started the year off briskly,...

Posted on

February 22, 2024

by

David Reimers

When comparing the real estate markets from coast to coast across Canada, a home with a price tag of $1 million can differ greatly. As the nation’s short supply persists and buyers struggle with affording housing, there remains a vast variation of the definition of a $1-million home across major markets. In examining what a budget of around $1 million – give or take $50,000 – can buy in Canada’s major housing markets, Royal LePage® determined in a new report that the average home in Canada...

Posted on

February 21, 2024

by

David Reimers

Bill 44 Housing Statutes (Residential Development) Amendment Act, 2023 has the potential to make housing for affordable by increasing the amount of small-scale multi-unit housing in neighbourhoods that are mostly comprised of single-family homes. This includes townhomes, triplexes and laneway homes, and a plan to fix outdated zoning rules to help the process of building homes quicker. These new zoning requirements would permit higher density in areas previously zoned for single family or...

Posted on

February 15, 2024

by

David Reimers

The Canadian government has recently announced a two-year extension to the ban on foreign ownership of Canadian housing. This move reflects the government's commitment to ensuring that Canadians have access to affordable housing, promoting stability in the real estate market, and addressing concerns about the impact of foreign investment on housing prices. The decision to extend the ban comes in the wake of growing concerns about the role of foreign investors in the Canadian real estate market. In...

Posted on

February 6, 2024

by

David Reimers

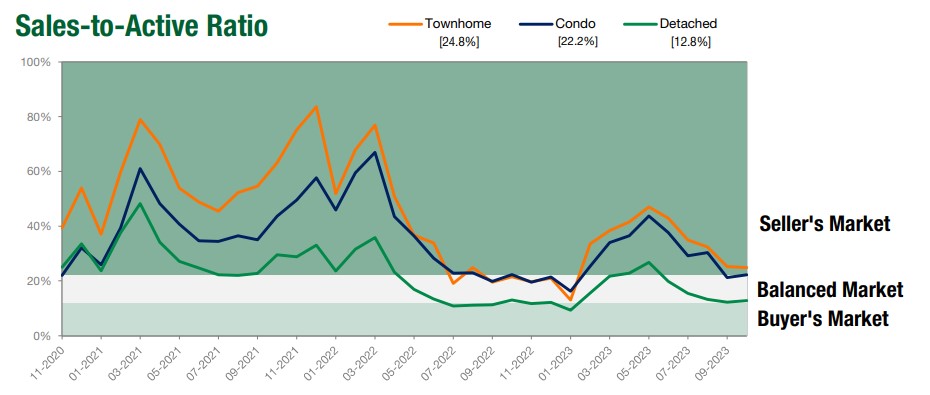

While the Metro Vancouver market ended 2023 in balanced market territory, in January conditions began shifting back in favor of sellers as the pace of newly listed properties did not keep up with the jump in home sales. The Real Estate Board of Greater Vancouver (REBGV) reports that in the region residential sales totaled 1,427 in January 2024, a 38.5% increase from the 1,030 sales recorded in January 2023. This was 20.2% below the 10-year seasonal average (1,788). “It’s hard to believe that...

Posted on

January 19, 2024

by

David Reimers

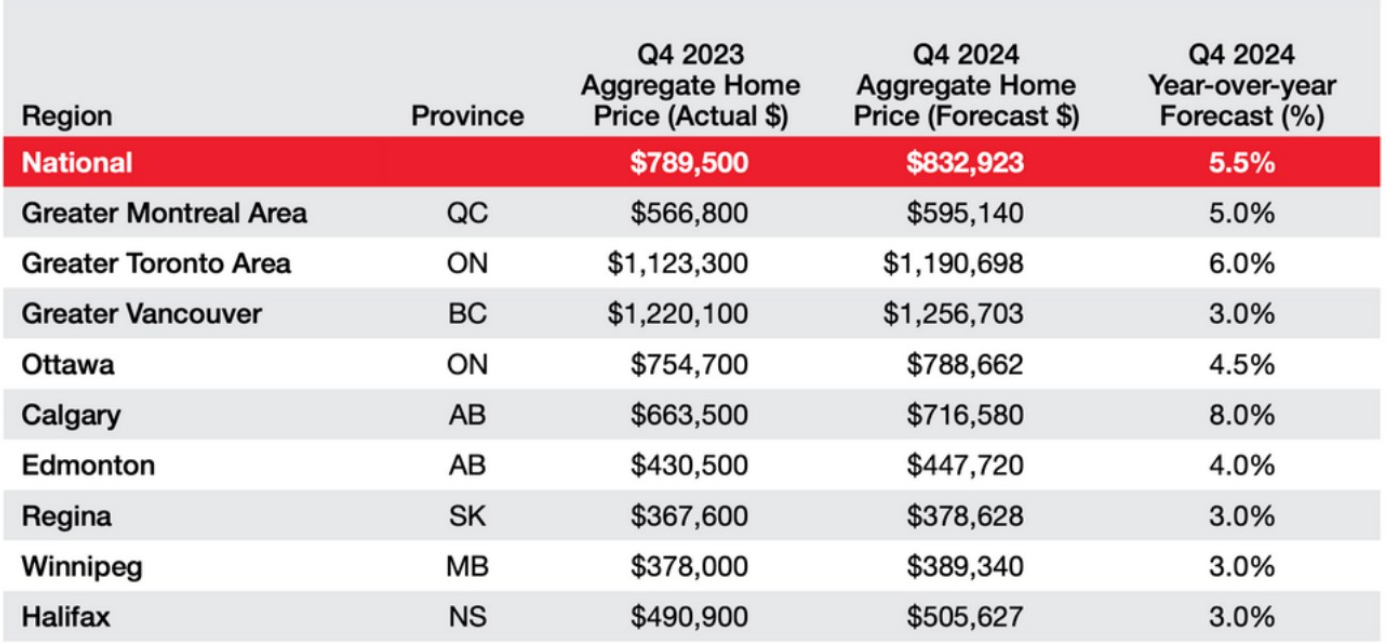

Royal LePage expects sidelined buyers to re-engage this quarter ahead of expected rate cuts by the Bank of Canada. National Summary National aggregate home price increased 4.3% year over year in Q4 2023; decreased 1.7% quarter over quarter. Aggregate home price in greater regions of Toronto, Montreal and Vancouver posted gains of 5.1%, 4.1% and 2.7% year over year, respectively, in final quarter of 2023. Among report’s major regions, Calgary recorded highest year over year price appreciation (10.7%);...

Posted on

January 8, 2024

by

David Reimers

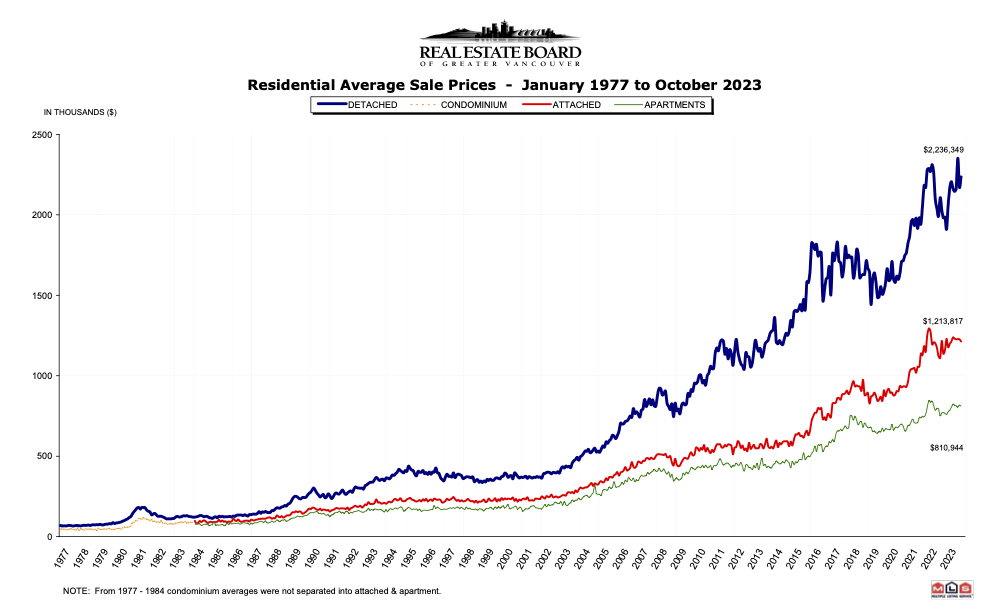

In 2023, Metro Vancouver’s housing market closed out with balanced market conditions, but the year-end totals there is a story of surprising resilience in the face of the highest borrowing costs seen in over a 10 years.

The Real Estate Board of Greater Vancouver (REBGV) reports that there was a total of 26,249 residential sales in the region in 2023, a 10.3 per cent decrease from the 29,261 sales recorded in 2022, and a 41.5 per cent decrease from the 44,884 sales in 2021. ...

Posted on

December 18, 2023

by

David Reimers

Canada’s housing market could return to more normal levels of activity and price trends next year, following several years of unprecedented ups and downs. The Bank of Canada is expected to lower its overnight lending rate in the second half of 2024, which will lead to an rise in demand from sidelined buyers as they adjust to today’s lending realities. New household formation and newcomers to Canada will put additional upward pressure on prices. “Looking ahead, we see 2024 as an important tipping...

Posted on

December 14, 2023

by

David Reimers

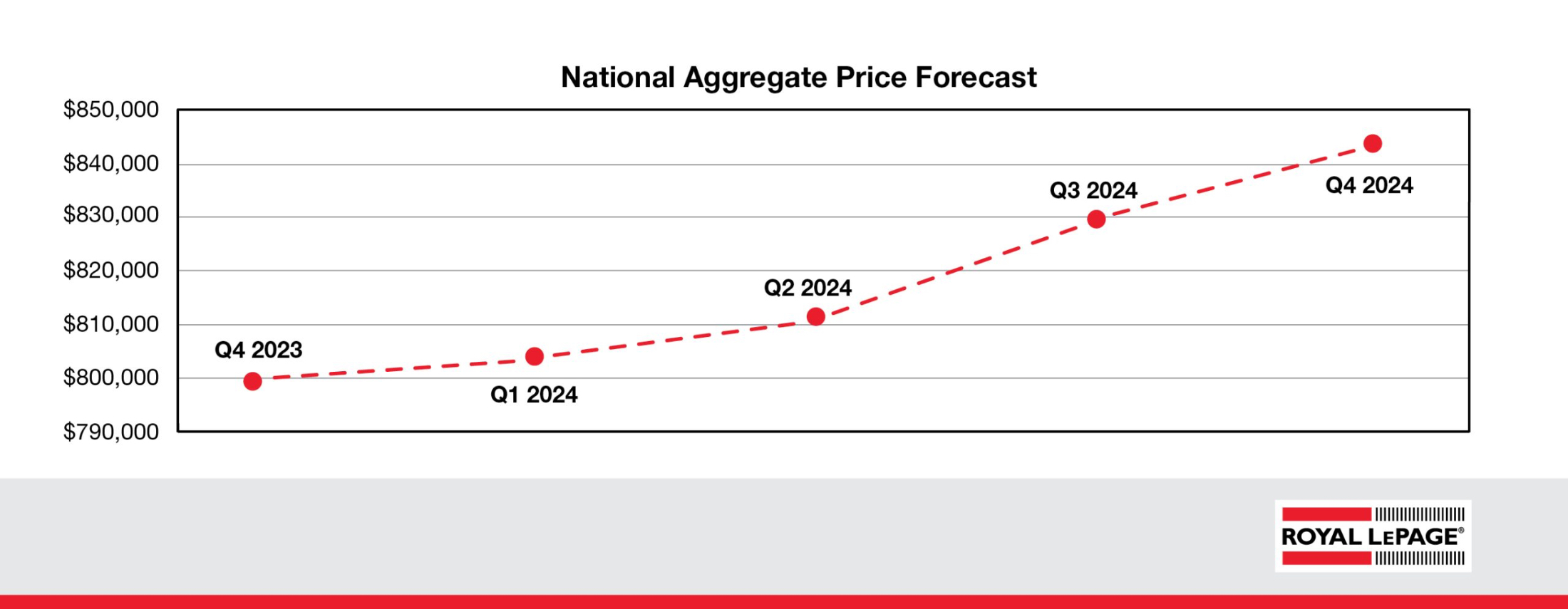

Canadians may see the real estate market return closer to normal in 2024, after years of unprecedented irregularity. According to the Royal LePage Market Survey Forecast, the aggregate price of a home in Canada is set to increase 5.5 per cent year over year to $843,684 in the fourth quarter of 2024, with the median price of a single-family detached property and condominium projected to increase 6.0 per cent and 5.0 to $879,164 and $616,140. “Looking ahead, we see 2024 as an important tipping point...

Posted on

December 7, 2023

by

David Reimers

The Bank of Canada is widely expected to hold its benchmark interest rate when it meets next week, but a lot has changed since October. Cooling inflation, here and south of the border, and a weakening economy have turned markets’ attention from rate hikes to rate cuts. Investors are now fully pricing in a 25 bps rate cut by April, a 75 per cent chance by March and even a 20 per cent chance by next week. Stephen Brown, deputy chief North American economist for Capital Economics, thinks odds of a cut...

Posted on

December 4, 2023

by

David Reimers

With 2023 coming to an end, a steady increase in housing inventory is offering home buyers across Metro Vancouver among the largest selection to choose from since 2021. The Real Estate Board of Greater Vancouver (REBGV) reports that residential sales in the region was 1,702 in November 2023, which was a 4.7% increase from the 1,625 sales recorded in last year in November. This was 33% below the 10-year seasonal average (2,538). Andrew Lis, REBGV’s director of economics and data analytics said,...

Posted on

November 29, 2023

by

David Reimers

Royal LePage predicts continued stability in Canada’s winter recreational real estate market as interest rates expected to hold or moderate National single-family home price in Canada’s winter recreational market decreased 0.7% year over year in the first 10 months of 2023 24% of Royal LePage recreational property market experts reported a decline in buyer demand this year as a result of climate factors or environmental disasters, following unprecedented wildfire season 41% of experts reported an increase...

Posted on

November 7, 2023

by

David Reimers

An increase in newly listed properties is providing more choice to home buyers across Metro Vancouver, but sales remain below long-term averages.

The Real Estate Board of Greater Vancouver (REBGV) reports that residential sales in the region totalled 1,996 in October 2023, a 3.7% increase from the 1,924 sales recorded in October 2022. This total is 29.5% below the 10-year seasonal average (2,832) for October.

"With properties coming to market at a rate roughly five% above the ten-year seasonal average,...

Posted on

November 7, 2023

by

David Reimers

Choosing the right REALTOR® is a crucial step to ensure your journey to buying or selling real estate in Coquitlam is a success. A skilled and experienced REALTOR® can make the process smoother and more successful, while an inexperienced or ineffective agent can lead to frustration and missed opportunities. To ensure you make the best choice, this blog post will guide you through the essential factors to consider when selecting the best Coquitlam REALTOR® for your needs. Experience and Local Knowledge...

|